Agent banking remittance rises 21% in Dec

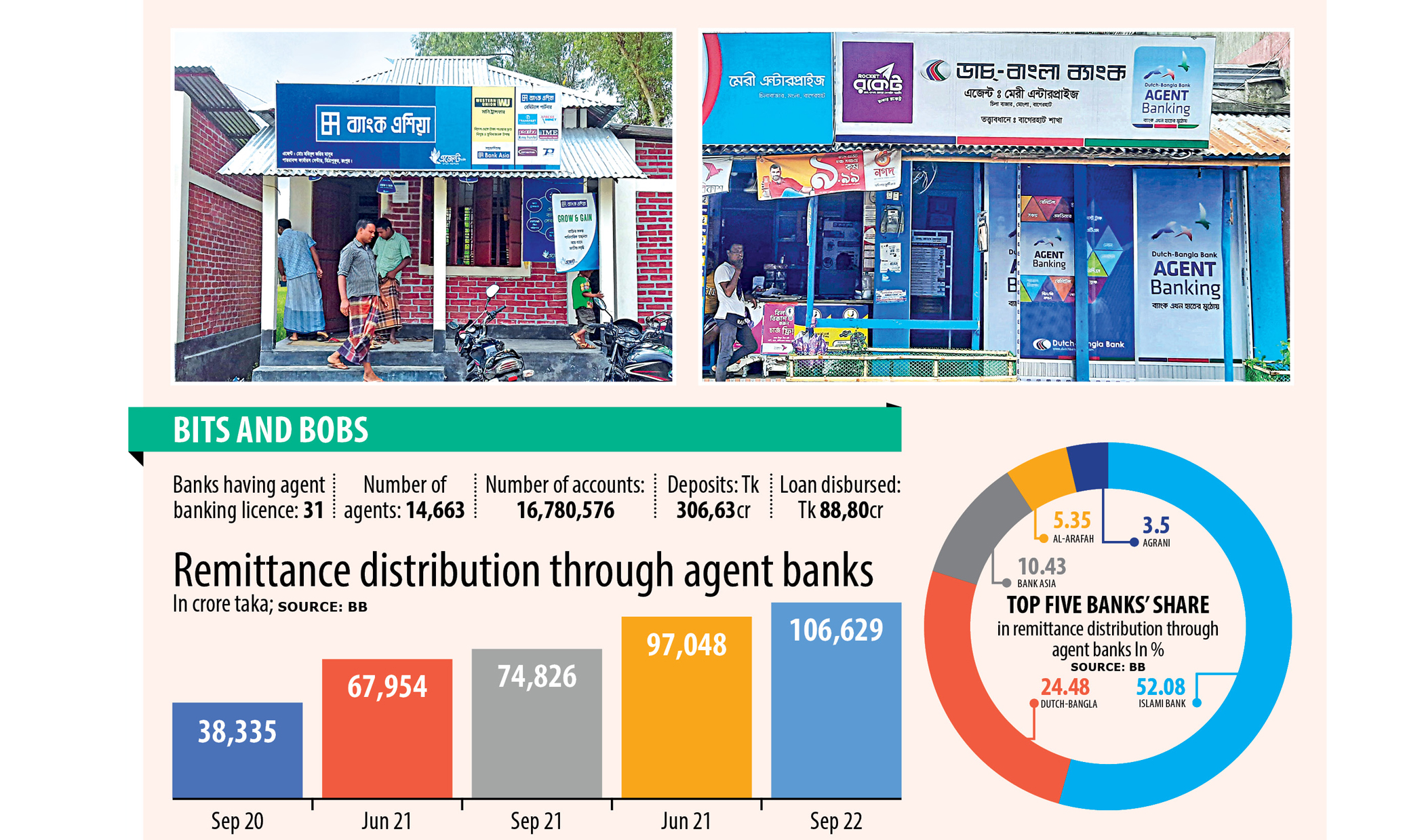

Disbursement of inward remittance through agent banking outlets rose 21 percent year-on-year in the last month of 2024, for which the central bank credits the government's 2.5 percent cash incentive.

The rural population received the lion's share of the inward remittance of Tk 173,390 crore, which was disbursed through agent banking outlets in December last year.

In December 2023, the figure was Tk 143,113 crore, which increased in September 2024 to Tk 165,659 crore but was still 4.67 percent lower than that of December 2024, according to the quarterly report on agent banking published by the Bangladesh Bank.

The banking watchdog also believes banks' financial literacy campaigns on the use of legal channels might have had a positive impact on the rising remittance inflow.

Agent banking accounts opened in rural areas have always been the major recipients of the remittance disbursed, as they received 90.12 percent of December 2024's total.

Of the total, only around 10 percent or Tk 7,731 crore was received by those with agent banking accounts in urban areas.

Other than remittance, agent banking outlets experienced a massive jump in the amount of loans disbursed, both quarterly and year-on-year.

The outlets of agent banking – introduced in 2013 to serve the underserved population – disbursed Tk 15,407 crore in loans in the 12th month of 2023, which rose 56 percent year-on-year to Tk 24,028 crore in the same month of 2024.

The latest figure was also around 14 percent higher than that of the September quarter's Tk 21,089 crore.

Rural customers also outnumbered their urban peers here by receiving 64 percent of the loans disbursed through agent banking.

Gender-wise, male borrowers took over four-fifths of the loans. Of the total, Tk 19,879 crore went to male account holders and a little over Tk 3,000 crore to females.

Twenty-three banks are currently engaged in lending through agent banking, and the banking regulator expects access to loans for female customers to widen when more banks begin extending the service.

"Nevertheless, there remains huge potential to reach more female entrepreneurs in rural areas who can access finance from banks through agents," the central bank said in the report.

"Bangladesh Bank is paying attention to this matter and constantly encouraging banks to facilitate female customers in obtaining loans."

Deposits accumulated through agent banking also rose year-on-year and quarterly, though at a slower pace than both inward remittance and loan disbursement.

In December 2024, deposits through agent banking increased 15.4 percent year-on-year to Tk 41,955 crore, which was also 6.14 percent higher than September 2024's Tk 39,529 crore.

Again, the major share of deposits, 80.45 percent, was collected from rural areas. Like borrowers, deposits in male customers' accounts outnumbered those in female accounts, holding 57 percent and 37.23 percent of the total, respectively.

Savings accounts comprised 41.93 percent of the deposits, while other categories, including institutional and term deposits, made up half of the total.

The remaining 7.13 percent belonged to current account holders, according to the BB report.

The report highlighted that the loan-to-deposit ratio in agent banking stood at only 57.27 percent in the December 2024 quarter, compared to 53.35 percent in the previous quarter.

"Increase in the loan-to-deposit ratio compared to the last quarter indicates that investment through agent outlets is gradually gaining momentum," the central bank said.

However, in the December 2024 quarter, only 23 out of 31 banks distributed loans through agent banking.

"The low lending-to-deposit ratio indicates that the agent banking window is serving banks' purposes more in deposit collection than lending."

The BB also found that rural people are still receiving fewer loan facilities against their deposits compared to urban areas.

In the report, it was mentioned that the loan-to-deposit ratio in rural areas was 45.88 percent in the December 2024 quarter, up from 42.51 percent in the September 2024 quarter.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments