21 life insurers failing to comply with securities investment rule

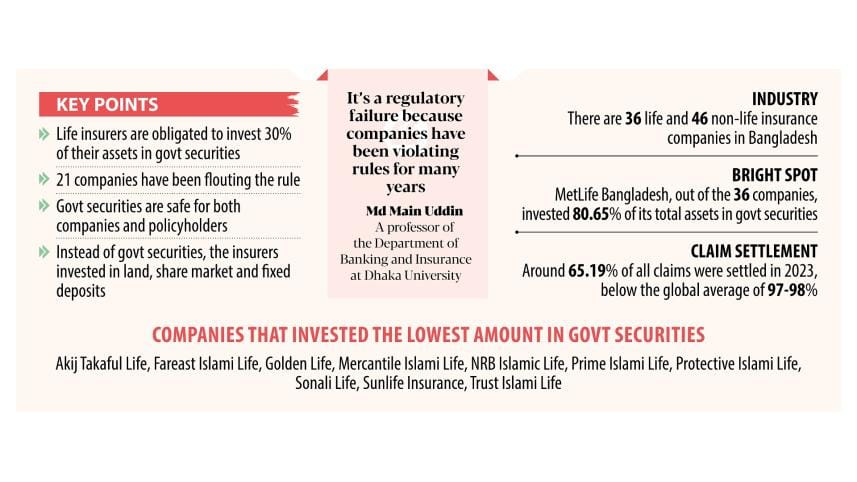

Twenty-one life insurance companies in Bangladesh have failed to comply with the rule that makes it mandatory for them to invest 30 percent of their assets in government securities, the regulator has found.

The companies are Akij Takaful, Alpha Islami, Baira, Bengal Islami, Best Life, Chartered Life, Diamond Life, Fareast Islami, Golden Life, Meghna Life, and Mercantile Islami.

Others are NRB Islamic Life, Padma Islami, Popular Life, Prime Islami, Protective Islami Life, Sonali Life, Sunflower Life, Sunlife, Trust Islami Life, and Zenith Islami Life Insurance.

The findings are based on the companies' unaudited financial reports for 2023, said an official of the Insurance Development and Regulatory Authority (Idra).

The Life Insurer's Asset Investment and Preservation Regulations 2019 state that insurance companies must invest at least 30 percent of their assets in treasury bills and bonds.

The Idra probe said the companies had been violating the law "for a long time". It did not specify any period.

If life insurance companies invest sufficiently in government securities, it is safe for both companies and policyholders, the regulator's report said.

The government can also use the funds for development purposes, so this needs to be given priority, it added.

However, instead of picking treasury bills and bonds, the 21 insurers chose land and properties, the stock market, and savings instruments of banks to park their funds, said a senior official of the regulator.

Of the 21 companies, nine ploughed less than 5 percent of their assets into government instruments while four have an investment of less than 15 percent and another four less than 25 percent.

The companies cited various reasons for the lack of investments.

Alpha Islami Life's investment in treasuries stood at 17.27 percent.

Nura Alam Siddikie Ovee, CEO of the company, said the company didn't do well from its inception in 2014 to 2019, hence investing was impossible.

He, however, said their current situation is better with claims payout of 100 percent last year.

"We are hopeful of attaining the investment target within this year," he said, adding that the insurer kept Tk 12 crore in fixed deposits at Islamic banks in April and May.

Akij Takaful parked 4.14 percent of its assets in securities.

Mohammed Alamgir Chowdhury, acting CEO of the company, said the company was formed in 2021 and it is yet to hit the investment ceiling.

"Our life fund amounts Tk 11 crore and it has been kept as deposits in banks."

A life fund is an amount of money that is paid to and invested by insurance companies for life insurance, and from which money is paid when someone dies.

Meghna Life's investment rate was 19.65 percent in government securities though its Vice Chairman Nasir Uddin Ahmed claimed it to be 21.2 percent.

"Fixed deposits and government securities were cashed in to settle claims, so the investment ratio has declined. We will try to meet the investment criteria."

Popular Life invested 17.35 percent in treasuries.

BM Yousuf Ali, managing director of the company, said investments in the stock market previously yielded higher returns, so the company invested in stocks.

"The investment shortfall in government securities will be fulfilled on a priority basis in the coming days."

MetLife Bangladesh has put the highest 80.65 percent of its assets in treasuries.

"Safeguarding policyholders' funds through strategic investments in secured and less volatile sectors is our priority," said Ala Ahmad, chief executive officer of the lone international insurance company operating in Bangladesh.

"This helps our customers remain confident about our financial strength and receive expected returns."

Speaking about insurers' reluctance to invest in securities, Nasir Uddin Ahmed, first vice-president of the Bangladesh Insurance Association, said while securities are the most secure, the long tenure deters companies from investing.

Md Main Uddin, a professor of the Department of Banking and Insurance at the University of Dhaka, has termed the non-compliance as a regulatory failure because companies have been violating the law for many years.

"Failure to punish the non-compliant companies has led to policyholders not getting money back even years after their policies reached maturity."

He said the Idra should place strong restrictions on investing in land.

Zahangir Alam, a spokesperson of the Idra, said companies that have invested too little in government securities were fined.

Insurers have been given one month to two months to comply with the rules, he said.

"Investment information is regularly monitored to ensure that companies make investments in line with rules," he said, adding that companies will have to explain if they can't adhere to rules and they will also face fines.

Although the data for 2023 was not available, the figures in the previous years showed that life insurance companies continued to put more than half of their investments in treasury bills and bonds.

Government bonds and bills accounted for 54 percent, 52 percent, and 53 percent of the total investments of insurers in 2020, 2021 and 2022 respectively.

Land and other properties accounted for 8.39 percent of their investments in 2022, up from 8.01 percent in 2021. Their collective fixed deposits with banks were 21.07 percent of the portfolios, down from 23.34 percent a year ago.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments