Wide gap in formal-informal exchange rates led to forex reserve slide: WB

A wide gap in formal and informal exchange rate has been one of the factors behind the sharp fall in the foreign exchange reserves in Bangladesh as it shifts remittances from official channels to unofficial routes and impedes repatriation of export proceeds, said the World Bank.

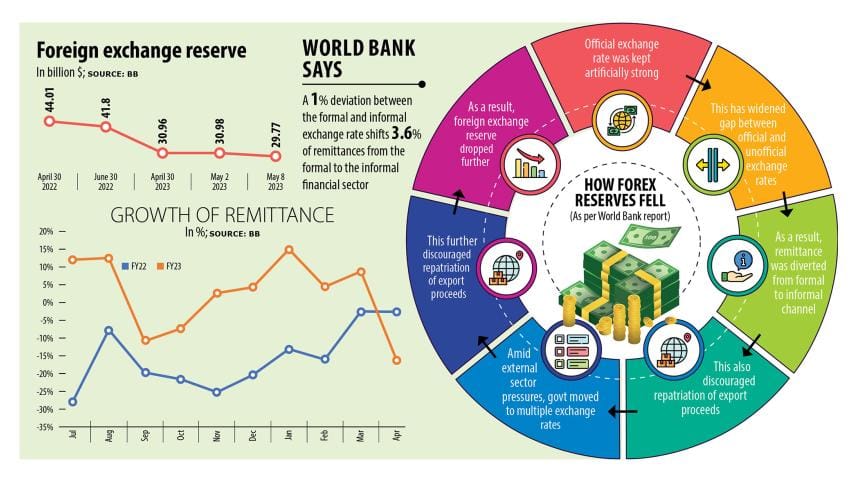

The observation comes as the country's foreign exchange reserves dropped 29.45 per cent to $29.77 billion in a span of one year owing to higher import bills against moderate export and remittance earnings, Bangladesh Bank data showed.

"The widening of the exchange rate gap and the uncertainty about exchange rates, in general, diverted remittance inflows away from official channels, especially as remitters can obtain more favourable market rates through unofficial channels," the WB said in a report.

In Bangladesh, a one-per cent deviation between the formal and informal exchange rate shifts 3.6 per cent of remittances from the formal to the informal financial sector, said the multilateral lender's latest regional economic update titled "Expanding Opportunities: Toward Inclusive Growth."

On the subject, a two-day conference began in Dhaka yesterday. The Brac Institute of Governance and Development (BIGD) and the WB jointly organised the event at the Brac Centre Inn.

According to the report, interventions in the foreign exchange market and declining official remittance inflows have reduced foreign reserves in most countries.

As countries sold US dollars to stabilise the exchange rate, the move brought down the level of reserves. The decline in official remittance inflows and export proceeds put further downward pressure on the reserves of the countries.

The report said as the official exchange rate was set at an artificially strong level that is inconsistent with the market, the gap between the interbank and the informal market widened in Bangladesh.

In 2021-22, external sector pressures rose due to rising commodity prices, a strengthening US dollar, sharp increases in imports, and declining official remittance inflows.

In response, the BB sold US dollars, which drew down foreign reserves. To address the mounting pressures, the central bank floated the exchange rate in June last year.

The policy led to a rapid exchange rate depreciation of 11 per cent against the US dollar. As a result of the reversal, the gap between official and unofficial exchange rates widened in August, which depleted foreign exchange liquidity in banks.

The taka has lost its value by about 25 per cent against the US dollar in the last year.

In September last year, Bangladesh moved to a multiple exchange rate regime with a less favourable rate for export proceeds than for remittances. The policy further discouraged exports and the repatriation of proceeds.

The rate has varied between as low as Tk 99.6 to as high as Tk 107 per USD so far.

Because of the gap between the exchange rates for imports and remittances, importers have incentives to over-invoice imports to buy more US dollars from banks and send the profits back as remittances. This rate arbitrage leads to a further decline in US dollar liquidity in banks, the report said.

"Parallel exchange rates discouraged the inflow of foreign currencies."

The report also talked about the asset quality of the banking sector, saying the asset quality of banks deteriorated.

"The NPL ratio has risen due to higher import costs, poor payment discipline of borrowers, and weak regulatory enforcement."

It said the resumption of lax loan rescheduling and asset classification in the middle of 2022 has delayed the full recognition of distressed assets.

The NPL ratios among non-bank financial institutions are even higher than in the banking sector, going past 23 per cent in June.

"Bangladesh has made significant progress in bridging gaps between low and high-opportunity groups, particularly in the education sector. However, much remains to be done," said Abdoulaye Seck, country director of the WB for Bangladesh and Bhutan, in the opening session of the conference.

He said South Asian countries must continue to reduce socioeconomic disparities as they lead to differences in access to jobs, earnings, consumption, and welfare, and impact overall growth.

"Inequality of opportunity is not only a matter of fairness, but it is also a matter of efficiency. It prevents an optimal allocation of talent and reduces incentives to accumulate human capital, and derails long-term economic growth."

Speaker of the Bangladesh Parliament Shirin Sharmin Chaudhury said inclusive growth, not just growth, is necessary for the development of the economy.

"Eradication of inequality needs to include in the arena of political economy so that inclusive growth is ensured."

The high levels of inequality of opportunity and low inter-generational mobility in South Asia are not only unjust but also impede long-term economic growth, according to Imran Matin, executive director of the BIGD.

"Policies to address it will create a more equitable society and help unlock the region's full potential. We should remember that lack of social progress means lack of social justice," he added.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments