WB criticises tax provision on legalising black money

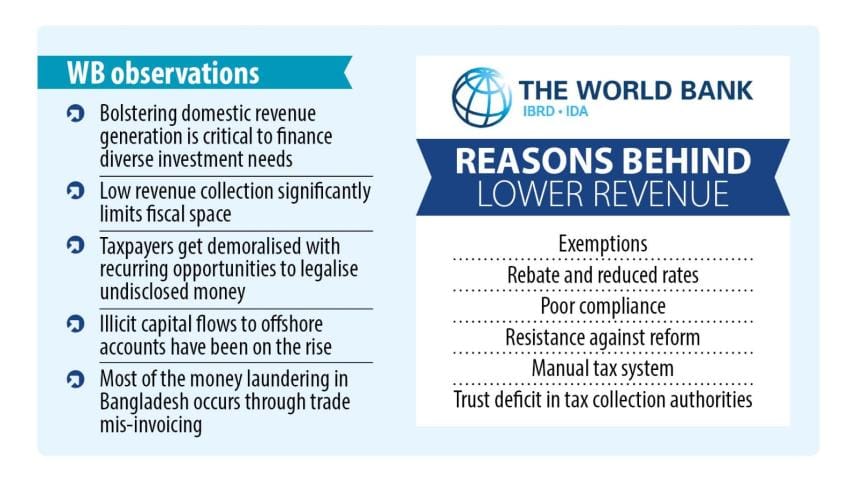

World Bank has criticised an existing government scope for legalising undisclosed wealth through investments, saying such policies demotivate honest and regular taxpayers and encourage tax evaders to continue with their misdeeds.

"Also, these policies have failed to earn a significant amount of revenue," said the Washington-based lender in its Bangladesh Development Update published yesterday.

At present, taxpayers show their undisclosed assets in their tax returns through investment in apartments, buildings and economic zones and high-tech parks.

Taxpayers have to pay a fixed amount of tax per square metre depending on the location of the flats and buildings, and 10 percent tax on the invested amount of black money in economic zones and high-tech parks.

As per the income tax law, any such investment "will be considered as ones which have already gone through the process of their source being explained" with field officials of the tax administration.

The government provided the opportunity to legalise black money without question in the fiscal year (FY) 2020-21.

The NBR got Tk 2,064 crore in tax, the highest on record in a year, with 11,859 taxpayers showing their undeclared assets in their tax returns.

The tax authority discontinued the provision in the FY 2021-22 and imposed rules that taxpayers will have to pay a 25 percent tax on the undisclosed amount and a 5 percent penalty on the payable tax. It got a lukewarm response.

In the publication, the WB ran a section with special focus on the importance of increased domestic resource mobilisation to meet the needs and development aspirations of Bangladesh, which has one of the lowest tax-to-GDP ratios.

The amount of tax collected by the country's National Board of Revenue (NBR) is significantly below its regional and aspirational peers.

The tax-to-GDP ratio declined from 9.1 percent in FY 2011-12 to 8.2 percent in FY23.

Bolstering domestic revenue generation is critical to finance diverse investment needs in the long term, said the WB.

"The low revenue collection significantly limits the fiscal space necessary for critical public investments in sectors such as energy, transportation, municipal infrastructure, human capital development, and social sector spending to support vulnerable sections of the population."

In its analysis on the reasons behind lower than potential revenue collection, the WB identified a number of issues.

These include exemptions, rebates and reduced rates, poor compliance, resistance against reform among revenue officials and businesses, manual taxation systems and a deficit of trust on the tax collection authorities.

Gaining the trust of honest taxpayers and those who are willing to pay their fair share could support revenue mobilisation, said the WB.

There is a concern among taxpayers that disclosure of the actual assets in the tax returns can result in tax-related harassment, it said.

"Honest taxpayers get frustrated when they are subjected to additional investigation, while evaders are not brought under scrutiny," it said.

"Moreover, taxpayers get demoralised with recurring opportunities to legalise undisclosed money," said the WB, adding that the NBR and the Anti-Corruption Commission were not allowed to raise any questions on such declarations.

"Such policies create a moral hazard problem and widen the trust deficit," it added.

A one-off decision to earn revenues through such measures can be beneficial in bringing some undisclosed assets under the system, it said.

However, continuation of such policies demotivates honest and regular taxpayers and encourages tax evaders to continue their misdeeds by creating an expectation that they will be able to legalise their wealth, said the WB.

Illicit capital flows through various means have been depriving the government of revenues, said the multilateral lender.

"Illicit capital flows to offshore accounts have been on the rise," it said, citing a State of the Tax Justice Report 2020 by Tax Justice Network.

The report estimated offshore financial wealth of Bangladeshis at 0.7 percent of the gross domestic product (GDP).

The tax and revenue losses, which include losses from corporate abuse and offshore tax evasion, are estimated at over $700 million or 2.2 percent of FY20 revenue, the WB said.

"This is high compared to some of Bangladesh's peer countries."

The WB said Bangladesh currently ranks 54 among 133 countries in the Financial Secrecy Index, which measures how intensely a country's tax and financial systems serve as a tool for individuals to hide their finances from the rule of law.

"Most of the money laundering in Bangladesh occurs through trade misinvoicing," it said referring to the Global Financial Integrity Report 2021.

The report estimates that as much as $3.6 billion per year was laundered from Bangladesh through trade misinvoicing on an average between 2009 and 2018.

"Bangladesh ranked 44th globally and 3rd in South Asia in terms of illicit outflows of money through trade misinvoicing," said the WB.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments