Three factors that could determine stock market recovery in 2024

Bangladesh might have bid adieu to 2023 but it could not leave behind the old problems that held it back throughout the turbulent year.

Likewise, the stock market passed a disappointing year for multiple factors ranging from lingering economic and political uncertainties and the floor price stemming from regulatory failures.

What is more, the equity market will face some fresh challenges as interest rates are expected to rise and investors and savers are returning to banks for better rates.

As a result, the market is unlikely to see any major improvement in its course in 2024.

Most shares on the Dhaka Stock Exchange (DSE) were unchanged in 2023 due to the floor price, which spooked the confidence level of investors, brokers, asset managers, and merchant bankers.

Macro-economic pressures have also hit investors' sentiment, so the index was flat throughout the year.

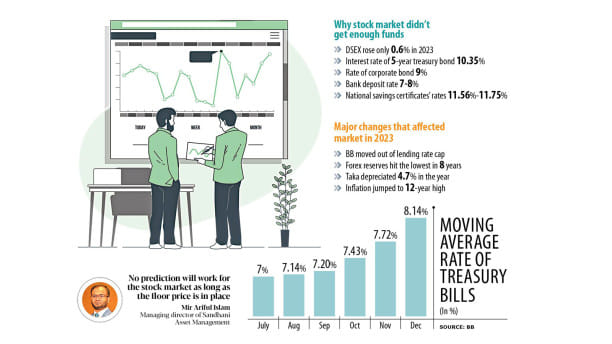

The DSEX, the benchmark index of the DSE, was up only 0.6 percent, or 40 points, at 6,246 at the end of 2023 compared to a year ago.

At the heart of the stock market's woes in the last one year has been the bruised macroeconomic scenario, driven by the challenges stemming from wars, escalated energy costs, a drastic fall in foreign currency reserves and the value of the taka, and higher inflation.

The challenges are expected to continue in 2024 as well unless the factors behind them change their direction overnight.

Adding to the challenges for the market include the higher bank interest rate and the rates of treasury bills.

The Bangladesh Securities and Exchange Commission set the floor price in the middle of 2022 in order to halt any erosion of indexes after the eruption of the Russia-Ukraine war. This has caused an erosion of the confidence of foreign and institutional investors.

So, three key factors, namely the floor price, the interest rates, and the macroeconomic challenges will determine whether the stock market of Bangladesh will make a comeback in 2024 or not.

"There is no hope for the stock market to make a comeback in the first six months of 2024 as the interest rate of treasury bonds rose, the FDR rate has gone up, and inflation has stayed at an elevated level," said a top official of an asset management company.

The yield of treasury bonds has already crossed 11 percent and it tends to rise further because the government will try to refrain itself from borrowing from the central bank and mobilise funds by selling bonds instead, he said.

When the interest rate of bonds and fixed deposit receipts (FDRs) rise, the funds flow from the stock market to the banking sector.

The asset manager says the government is buying US dollars from banks in the exchange of the taka, increasing the money supply in the economy – a move that may stoke inflationary pressures.

When inflation goes up, the interest rate on FDRs and treasury bonds also increases. So, there is little hope to see a pickup in the flow of funds to the stock market.

"This is because if a fund manager gets more than 11 percent return by putting funds in treasury bonds, he will invest in the instrument instead of keeping funds in a risky tool like stocks."

The bank interest rate is also set to rise.

The benchmark rate known as SMART (six-month moving average rate of treasury bills) stands at 8.14 percent currently, meaning banks can charge as high as 12 percent for loans. It was capped at 9 percent between April 2020 and June this year.

If the lending rate moves up, the deposit rate will also see an upward trend. This will result in the movement of funds from the stock market to the banking system.

Another blow might come from the depreciating taka since foreign investors try to dispose of their holdings when the local currency falls significantly, he said.

The taka has lost its value by about 25 percent against the US dollars in the past two years and the trend might continue in the new year.

"No prediction will work for the stock market as long as the floor price is in place," said Mir Ariful Islam, managing director of Sandhani Asset Management.

He says if the floor is lifted, the index might fall or rise initially.

According to Islam, the new government may instill a new hope in the market by focusing on the financial recovery. "If the macroeconomic indicators recover, the stock market may also make a comeback."

A merchant banker points out that although the market's fate will depend on the macroeconomic scenario, the government is yet to take any significant policy reforms to revive the ailing economy.

Performance of the listed companies has not been encouraging, keeping investors at bay.

In the first nine months of 2023, many companies saw a decline in profits. The profit situation may deteriorate further this year owing to higher inflation, wages and raw material prices.

"This will ultimately affect the index," the merchant banker added.

"Until the floor price is removed, investors' confidence will not receive any boost," said Abdul Mannan, a stock investor.

"I have been able to trade only a low number of shares in the last one and a half years in the absence of buyers though I needed to sell shares six months ago."

Of the 347 companies that trade on the premier bourse of the country, the price of 182 was stuck at the floor price at the end of 2023, DSE data showed.

"Some investors who paid heed to rumours earned money while honest investors sat idle. I don't want to see the same picture in 2024," Mannan added.

The stocks of 14 multinational companies rose 1 percent and the 10 largest blue-chip companies grew 0.4 percent in the last one year, highlighting the perils that most investors faced in 2023.

On the other hand, nine out of top 10 gainers either belonged to the "B" category or the "Z" category although these firms failed to pay a minimum dividend to shareholders due to weak earnings.

Of the nine, stocks of Khan Brothers PP Woven Bag surged seven times and Legacy Footwear skyrocketed three times. The rest more than doubled.

"We hope that the new government will focus on ensuring governance in the market so that junk stocks can't dominate," said Saiful Islam, president of the DSE Brokers Association.

He said the floor price has not only squeezed the business of stock brokers, but also the stock exchanges as turnover tumbled.

Average daily turnover on the DSE decreased 39.8 percent to Tk 578 crore in 2023, following a 34.9 percent drop in 2022.

Saiful Islam hopes the near impasse created in the market for the floor price will be removed by the new government.

"The new government must scrap the floor price immediately without bothering about the impact it may have on the index. Then, it should ensure a higher supply of well-performing companies in the stock market."

"A good number of sound companies is crucial to elevate the confidence of stock investors," he said, adding state-run companies that are in good shape should be asked to go public initially.

"At the same time, the regulator needs to be strict on ensuring good governance."

In its analysis, a brokerage firm said it sees 2024 as a year with key turnarounds awaiting, regarding post-election policy stability, interest rate plateauing, exchange rate stabilisation, and industry consolidation amid an economy trying to overcome shocks.

Added incentive is the delayed impact of the floor price removal, and the associated bargain opportunities that did not materialise in 2023 over policy misfire, said the analysis prepared for its clients.

It says following the election on January 7, a major part of policy worries will be answered in the first quarter of the year.

As macroeconomic challenges have been getting the highest attention for a while, the brokerage house hopes the new government will act strongly to manage them by removing policy roadblocks, bolstering external inflows, and ending volatility in the foreign exchange market and the exchange rate regime.

It expects the rising interest rates to peak in the first half, finding a higher equilibrium.

"All this will lead to a softer-than-anticipated landing for the economy, giving a better overall outlook from the second half of 2024."

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments