Textile millers seek a way out as gas crisis worsens

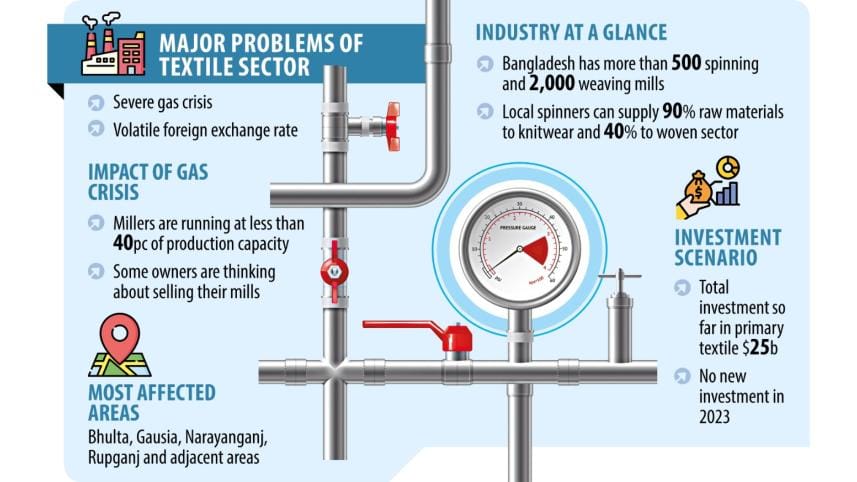

Faced with a chronic gas crisis and volatile exchange rates, a number of ailing textile millers are putting their factories up for sale as they are no longer able to contend with losses stemming from dwindling production.

Spinning, dyeing, weaving, finishing, and printing millers are prepared to sell their units, Bangladesh Textile Mills Association (BTMA) President Mohammad Ali Khokon said over the phone on Saturday.

So far, dealers from 10 mills have contacted the president and offered to sell their establishments, he added.

"The millers did not reveal their names as they have loans with banks, but their dealers contacted me."

Owing to the gas crisis, the volatile exchange rate, the rising bank interest rate, and growing costs of production, many millers, especially small and medium enterprises, are looking to sell their mills as they fear they can no longer be competitive in the textile business.

This comes at a time when the primary textile sector is enduring a tough time due to a fall in demand for garment items amid higher inflationary pressure on western consumers.

Because of the combination of these reasons, last year no new investment was made in the sector, a key pillar of the garment industry, the second largest in the world and the biggest source of foreign currencies for Bangladesh.

The gas crisis began a few years ago, but the situation has turned dire over the past few months as mills have been getting very low pressure, between zero and 2 PSI, from pipelines.

As a result, mills are running at an average of 40 percent of their capacity, denting their profit margin.

Around $25 billion is invested in the primary textile sector, according to the BTMA, which represents 500 spinning mills and 2,000 weaving members and non-members.

Currently, local spinning mills can supply nearly 90 percent of the raw materials to the knitwear sector and more than 40 percent to the woven sector.

Millers, spinners, weavers and dyers imported a lot of capital machinery in 2021 and 2022 as the global apparel supply chain was recovering fast from the severe fallout of the Covid-19 pandemic.

Since demand for apparel, especially for fabrics from man-made fibres, increased due to high demand from consumers, local millers imported capital machinery to grab a larger share of the global non-cotton market, worth around $760 billion.

However, they could not launch operations because of the gas crisis. Instead, many are looking to sell their units.

Md Saleudh Zaman Khan, chairman of NZ Denim Ltd, said production was falling day by day.

He added that, after many days, the gas supply had improved for eight hours on Friday before falling again.

"Now, the government is reducing export incentives, a move which will have a significant impact on the sector."

The government has cut the export subsidy for almost all sectors to reduce the pressures on Bangladesh's coffers and bring down the rates gradually since the country can't provide such subsidies once it becomes a developing nation. The cut came into effect on January 1.

Millers say the situation in Narayanganj, Rupganj, Bhulta, Gaussia and Narsingdi has been so severe over the past month that factory owners are losing money.

Khokon said at a press conference last week that many mill owners were becoming uncompetitive and losing money due to the gas crisis.

Ahsan H Mansur, executive director of the Policy Research Institute, said the government must ensure the supply of gas with adequate pressure to textile units, but at international prices.

"Do not subsidise prices for them."

The economist said renewable energies could be a good source of power but installing solar panels is expensive because of high import duty.

"The textile sector's investment is huge and they need an adequate gas supply."

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments