Taka third weakest currency in South Asia

The taka has been rendered one of the worst-performing currencies in South Asia in the last one year because of the plummeting foreign exchange reserves of Bangladesh for higher import payments.

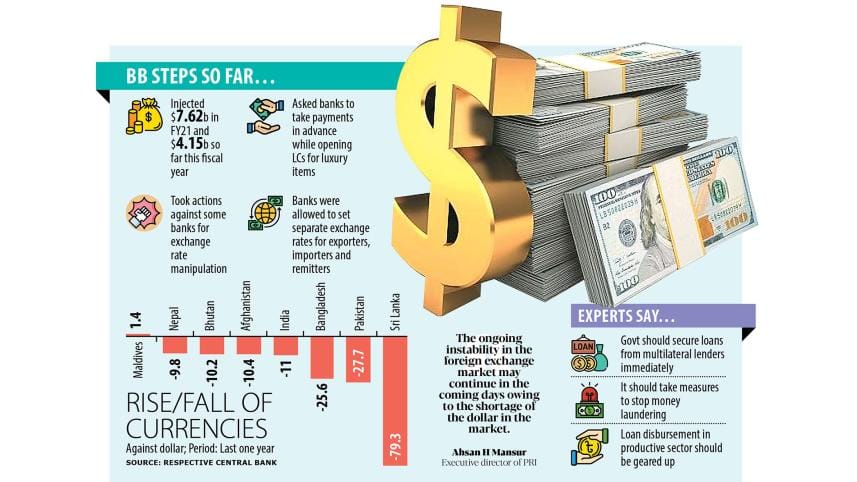

The exchange rate of the local currency stood at Tk 107.5 per US dollar on October 10, down 25.6 per cent from a year earlier.

The two other currencies – the Sri Lankan rupee and the Pakistani rupee – performed worse than the taka during the period: the Sri Lankan rupee fell by 79.3 per cent, while the Pakistani rupee was down 27.7 per cent, central banks data showed.

Although the currencies of other nations in the region have performed better than the three countries, they have also faced depreciation substantially, with the Maldives being the exception. The country's currency has appreciated against the American greenback by 1.4 per cent in the past one year.

In fact, most currencies around the world have fallen against the US dollar in the recent periods, owing to rapidly rising US interest rates and a more favourable terms-of-trade for the world's biggest economy caused by the energy crisis.

The US dollar is now at its highest level since 2000, having appreciated 22 per cent against the Japanese yen, 13 per cent against the euro and 6 per cent against emerging market currencies since the start of 2022, according to the International Monetary Fund.

Such a sharp strengthening of the dollar in a matter of months has sizable macroeconomic implications for almost all countries, given the dominance of the dollar in international trade and finance, said the IMF.

Considering the current global uncertainty and the growing threat of recession, the ongoing volatility in Bangladesh's foreign exchange market may not come to an end soon.

Ahsan H Mansur, executive director of the Policy Research Institute of Bangladesh, warns that the ongoing instability in the foreign exchange market may continue in the coming days owing to the shortage of the dollar in the market.

Foreign exchange reserves dropped to $36.3 billion on October 12 in contrast to $36.5 billion on September 29. The reserves amounted to $46.2 billion in September last year.

In order to settle import bills and shore up the taka, the Bangladesh Bank has supplied $4.15 billion to the market so far in the current fiscal year.

But Mansur said it might not be possible for the central bank to maintain the existing pace of dollar injection after three to four months as reserves have fallen substantially.

"If reserves keep declining at the current rate, the central bank will not have much leeway to sell US dollars after three to four months."

Bangladesh is not alone when it comes to the declining trend of reserves. In fact, total foreign reserves held by emerging markets and developing economies fell by more than 6 per cent in the first seven months of this year, said the IMF.

"If remittances and export earnings increase in the months ahead, the economy will get a respite from the current stress," said Mansur.

But the export and remittance sectors are already under strain.

Overseas sales slipped 6.25 per cent year-on-year to $3.9 billion in September, the first fall in 14 months, while remittances declined 11 per cent to $1.54 billion, the lowest in seven months.

State-run banks are now purchasing most of the dollars from the BB to settle import bills opened by the Bangladesh Petroleum Corporation.

"We should take concerted efforts to halt the depreciation of the local currency to protect reserves. The government should manage loans from the IMF immediately to tackle the situation," said Mansur.

The Indian currency has also lost its value in recent months, but the rate of its depreciation is much lower than the taka as the neighbouring nation allows its currency to move in keeping with demand and supply.

But Bangladesh has not done it on time. As a result, the taka has suffered shock recently.

Monzur Hossain, research director of the Bangladesh Institute of Development Studies, says that Bangladesh has been able to manage its exchange rate more efficiently than Sri Lanka and Pakistan.

"But the central bank should have managed it more competently than what it has done."

The BB had initially tried to manage the exchange rate in its own way but failed to do so as there was speculation in the market that the taka would lose against the US dollar.

Hossain describes the ongoing practice of banks fixing the exchange rate of the taka for exporters, importers and remitters in line with their own formula as undesirable.

"The main issue is that the stress in the foreign exchange market is continuing. And there is a strong possibility that the central bank may face difficulties in keeping the exchange rate stable in the days ahead," he said.

"The supply of the dollar to the local market is not adequate compared to its demand because of the ongoing global uncertainty."

Salehuddin Ahmed, a former governor of the central bank, says that the taka has nosedived faster compared to the currencies in South Asia.

"Although the economy is in good shape, the trend of depreciation is not a good thing for the country. It is worrisome that there are no coordinated efforts to fortify the macroeconomy."

For instance, he said, the country should take measures to stop money laundering and contain the private sector borrowing from external sources.

Private companies in Bangladesh took foreign loans to the tune of $25.95 billion as of June, up 39 per cent year-on-year.

"Besides, the central bank should emphasise disbursing more loans to the productive sector so that essential goods can be produced smoothly," said Ahmed.

Some policymakers argue that the ongoing volatility will be managed within one or two months. Ahmed disagrees, saying the way of thinking to resolve stress is not the right one.

Countries must preserve vital foreign reserves to deal with potentially worse outflows and turmoil in the future, recommended the IMF recently.

"Countries with sound economic policies in need of addressing moderate vulnerabilities should proactively avail themselves of the IMF's precautionary lines to meet future liquidity needs."

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments