Packaging industry bears the brunt of slowdown in other sectors

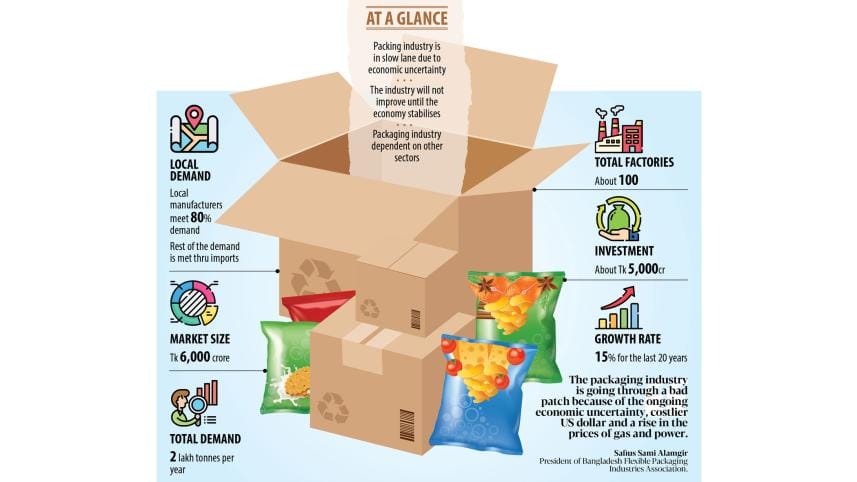

The growth of the country's packaging industry is in a slow lane due to the persisting economic uncertainty and the impacts of the price hike of the US dollar, gas and electricity, according to industry people.

The packaging industry is a backward linkage sector and relies on sectors such as food-processing and readymade garments. As a result, the industry has been in trouble for the past 18 months owing to the slowdown that has hit the overall economy.

"Like other sectors, the packaging industry is going through a bad patch because of the ongoing economic uncertainty and the impact of the costlier US dollar and the increase in the prices for gas and power," said Safius Sami Alamgir, president of the Bangladesh Flexible Packaging Industries Association.

The sector expanded at an annual pace of 10 percent to 12 percent from 2000 to 2010 while at around 20 percent in the decade before the coronavirus pandemic struck Bangladesh in keeping with steady economic growth, he said.

"The market grew on the back of a boom in the manufacturing of consumer products locally. But the demand has now stagnated due to the impact of the global economic crisis and higher inflationary pressure at home."

In Bangladesh, the overall market size of the packaging industry is around Tk 6,000 crore and the annual demand for packaging products stands at 2 lakh tonnes.

Alamgir is also the managing director of Tampaco Foils Ltd, one of the top manufacturers in Bangladesh and the pioneer in the sector. It was set up in 1978.

Currently, there are more than 100 packaging factories in Bangladesh. However, the number of major manufacturers is low.

The large producers are Arbab Poly Pack Ltd, AGI, Famous Printing and Packaging, Merchant Packaging Industries, Premiaflex Plastics, Shajinaz Eximpack, Meghna Packaging, r-pac Bangladesh, and Mohona Packages and they collectively meet more than half of the annual demand.

According to Alamgir, it costs Tk 100 crore to establish a medium-sized packaging factory and entrepreneurs in the sector have invested more than Tk 5,000 crore.

M Hossain Iraz, director for operations at Akij Biax Films Ltd (ABFL), also said the industry is going through a dull period since the other sectors it caters to are also struggling to survive.

The company entered the sector in 2018 with an investment of more than Tk 1,000 crore in a bid to capture a slice of the growing local market and diversify the country's export basket.

Iraz said ABFL is the only plant in the country that produces films for both single-layer unprinted flexible packaging and multilayer printed flexible packaging.

Its production capacity stands at 80,000 tonnes per annum.

He alleged that there are a number of importers who bring in packaging raw materials under bonded warehouse facilities and sell them in the local market although they are meant to be used in export-oriented goods alone.

At this crisis period, there is a need to ensure compliance and fair competition in the market, he said.

Pran-RFL Group set up a packaging plant in 2010 to produce items that would be used by its own factories.

The conglomerate sells packaging items to other companies on a very limited scale after meeting its demand. Sometimes, it has to purchase from others when it needs extra products, said Kamruzzaman Kamal, marketing director of the company.

He said the demand is low since consumers' purchasing capacity has eroded owing to higher inflation.

Inflation in Bangladesh has stayed at an elevated level for more than a year.

The Consumer Price Index rose to a 12-year high of 9.02 percent in 2022-23 against the government's revised target of 7.5 percent, according to the Bangladesh Bureau of Statistics.

Kamrul Islam Likhon, general manager of Arbab Poly Pack, blames over-investment and over-capacity of the existing manufacturers for their current woes.

The overall manufacturing capacity of the sector has reached around 4 lakh tonnes against a demand for packaging materials of 2 lakh tonnes, he said.

"We entered the market 38 years ago when the number of manufacturers was low and the business growth was healthy."

Despite the over-capacity, Bangladesh still has to rely on the external market to meet 20 percent of the demand for packaging materials since there are some products that local manufacturers don't produce.

Tampaco Foils' Alamgir does not see any possibility for the packaging industry to return to the pre-crisis growth trajectory until the economy returns to normalcy.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments