Garment export order falls 20pc as inflation, war bite

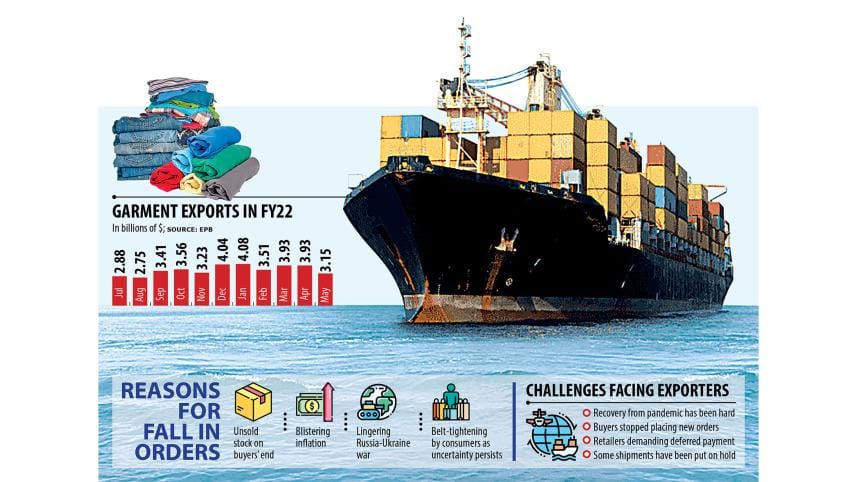

Work orders to the garment sector in Bangladesh fell by more than 20 per cent for the September and November season as consumers in the western world are tightening their belts owing to blistering inflation and deepening uncertainty caused by the Russia-Ukraine war.

In another unpromising sign for the country's biggest foreign currency earner, the risks for the US and the European Union, the two largest export destinations for Bangladesh, falling into recession are growing.

"International clothing retailers and brands have cut the work orders by 20 per cent for the September to November season compared to the March to June season," said Faruque Hassan, president of the Bangladesh Garment Manufacturers and Exporters Association.

Kutubuddin Ahmed, chairman of Envoy Textiles, one of the top garment exporters in Bangladesh, says stores of major retailers and brands have a large volume of unsold inventory. So, they are either stopping placing new orders, demanding deferral payments or urging suppliers to put shipments on hold.

The fall in orders came at a time when the industry has been recovering from the coronavirus-induced slowdown at a healthy pace.

As the world recovered from the health crisis, retailers and brands had placed an abnormally high work order to meet a surge in demand.

Since September last year, Bangladesh had posted higher exports and it continued until April. The momentum did not continue in May because of the fallout of the war, said Ahmed, who shipped high-end denim garments worth $110 million to Europe and the US in the last fiscal year.

The garment shipment of Bangladesh fell to $3.16 billion in May from $3.93 billion in April because of the fallout of the conflict.

The impacts of the falling work orders could be felt in the next fiscal year, starting on July 1, as well.

"If the war does not stop, the shipment may worsen because the decline in order will not be limited to 20 per cent," said Md Fazlul Hoque, managing director of Plummy Fashions Ltd, one of the greenest factories in Bangladesh.

Inflationary pressure is being felt all over the world, not just in the US and the EU, owing to escalated global commodity prices, energy crunch, and supply bottlenecks.

And World Bank Group President David Malpass yesterday said it might take even two years to get prices back under control as the US and other economies face inflation rates not seen in decades.

Researchers at the International Monetary Fund earlier made a similar prediction.

The situation for small and medium-sized garment units is worsening because of the decreasing orders and many are not receiving subcontracting work from the big local garment units as well, Hassan said.

The BGMEA chief says the war has hurt the global economy and driven up inflation, forcing the consumers to change their consumption patterns as higher prices bite into earnings.

For instance, consumers have been compelled to cut back their budget on clothing items in order to free up money to purchase costlier fuel and food.

In both the US and the EU, gas prices have trebled.

The World Bank's Food Commodity Price Index, which reached a record high in nominal terms in the March-April period of 2022, is up 15 per cent over the previous two months and more than 80 per cent higher than two years ago.

The higher expenses on energy and food have ultimately affected the garment supplying countries like Bangladesh, Hassan said.

The demand for yarn is very low now as many international retailers and brands have put their orders either on hold or suspended them, according to A Matin Chowdhury, managing director of Malek Spinning Mills Ltd.

Mohammad Hatem, executive president of the Bangladesh Knitwear Manufacturers and Exporters Association, said the inflow of work orders is declining because of the piling up of old stocks.

But the challenges for the exporters might not be over anytime soon since the case for a global recession is strengthening.

Goldman Sachs, an American multinational investment bank and financial services company, has forecast a 30 per cent chance of the US economy tipping into recession over the next year, up from 15 per cent earlier.

Morgan Stanley, another American multinational investment management and financial services firm, places the US recession odds for the next 12 months at around 35 per cent, according to Reuters.

Citigroup forecasts a near 50 per cent probability of global recession.

In a Senate hearing on Wednesday, US Federal Reserve Chair Jerome Powell acknowledged that a recession is possible as the Fed pushes borrowing costs steadily higher.

As the possibility of a recession rises, more and more people will choose to cut back on their consumption to keep their head above the water, bringing more bad news for Bangladesh's garment exporters.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments