Exports rise slightly in August

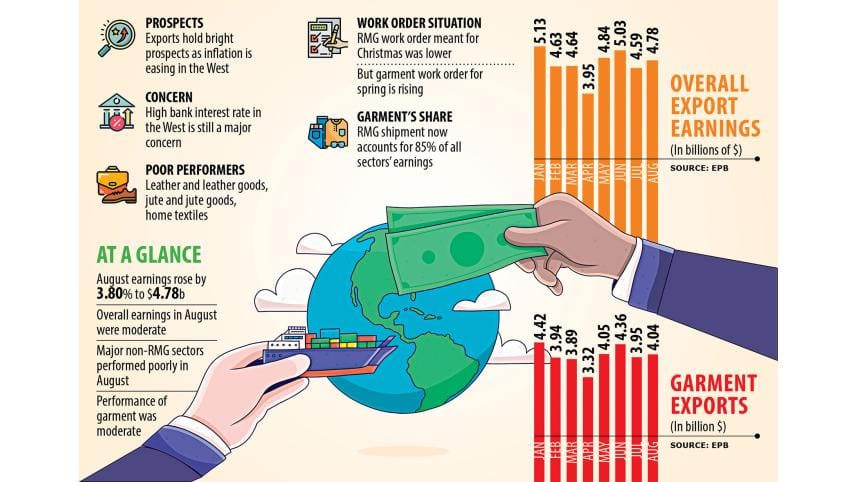

Earnings from merchandise shipments in August increased slightly by 3.80 percent to $4.78 billion, mainly riding on apparel exports as all the other major sectors staged a poor performance last month.

Three important sectors, including leather and leather goods, jute and jute goods and home textiles, which earned over $1 billion last fiscal year, staged a very poor performance.

This was largely due to the volatile global economic situation stemming from the severe fallouts of the pandemic and Russia-Ukraine war.

Although inflation is going down in the major export destinations in Europe and North American countries, including the US, bank interest rates are still high.

As a result, end consumers are yet to go on spending sprees as in the pre-pandemic period.

The shipment of goods like apparel, footwear and other fashion items will not be robust this year too ahead of Christmas, as consumers are still passing a hard time for the bank interest rates.

Compared with other major suppliers in the global supply chain, Bangladesh performed well amid the economic turmoil worldwide.

For instance, China's exports fell for the third month in a row in July, plunging by 14.5 percent year-on-year in dollar terms. This was the biggest drop since February 2020, when the pandemic began, The Telegraph reported last month.

Bangladesh's earnings in August are also 1.81 percent below the monthly target of $4.87 billion set by the Export Promotion Bureau (EPB).

Earnings from merchandise shipments in August last year stood at $4.60 billion, according to data from the state-owned export promotion agency of Bangladesh.

In the July-August period, the export grew by 9.12 percent year-on-year to $9.37 billion, the data said.

Bangladesh performed relatively better than other garment exporting countries, said Faruque Hassan, president of the Bangladesh Garment Manufacturers and Exporters Association (BGMEA).

The export of garments in August last year was robust as retailers and brands had to cater to pent-up demand of the pandemic in tune with the recovery of the global supply chain.

So, the same rate of export will not happen every year, he said.

In August alone this year, garment shipments grew by 7.99 percent to $4.04 billion, which is better than that of other countries.

Bangladesh has performed better in the new and emerging markets than in the traditional markets, which include the US, EU, UK and Canada, Hassan added.

He also said garment shipments may gain a good pace from December onwards as inflationary pressure was easing on consumers.

In the July-August period, the first two months of the current fiscal year, apparel shipments, which contribute more than 85 percent of the national exports, grew by 12.46 percent year-on-year to $7.99 billion, said EPB data.

Of the total, $4.58 billion was earned from the shipment of knitwear, which registered 17.02 percent year-on-year growth.

The remaining $3.41 billion was fetched from the shipment of woven garments, which registered 6.86 percent year-on-year growth.

Other major sectors could not perform well last month. For instance, leather and leather goods shipments fell by 12.73 percent year-on-year to $194.82 million.

The recession in Europe is still ongoing and consumers are not buying non-essential goods like leather goods, said Md Saiful Islam, former president of the Leathergoods and Footwear Manufacturers & Exporters Association of Bangladesh.

The pandemic and Russia-Ukraine war are still affecting the spending of consumers, said Islam, also president of the Metropolitan Chamber of Commerce and Industry (MCCI) and managing director of Picard Bangladesh Ltd.

Similarly, shipments of jute and jute goods declined 10.31 percent year-on-year to $140.46 million in the July-August period of the current fiscal year.

Though jute goods exporters get a government incentive, there is also a tax on it, which is disappointing, said Md Saiful Islam, managing director of Faridpur-based Mazeda Jute Industries Ltd.

Some 90 percent of Bangladesh's jute and jute goods are exported to 12 countries, which add more value to the products and reexport them to the rest of the world, he said.

But Bangladeshi jute exporters cannot exploit the demand of the rest of the world for a lack of proper marketing strategies, he said.

The Indian anti-dumping duty on Bangladeshi jute goods is also discouraging local exporters, he said.

Of the total jute goods, some 70 percent is yarn, 20 percent is sacks and 10 percent is other goods and those goods face such duty in India.

However, raw jute does not face any duty in India. As a result, 13 lakh tonnes of jute were exported to India over the last three years, said Islam, also a former director of the Bangladesh Jute Spinners Association.

Moreover, consumers are preferring other alternatives like polythene bags because of jute goods costing higher, he added.

Sectors like cotton waste, plastic goods and non-leather footwear performed well in the July-August period.

Home textile exports fell 53.40 percent to $125.14 million as demand fell globally. Shipments of sectors like frozen and live fish, agricultural products and ceramics did not fare that well in the July-August period.

Exports were robust in August last year, said Mohammad Abdur Razzaque, research director of the Policy Research Institute. As a result, the exports seem slower on a year-on-year comparison.

Still the exports of Bangladesh are better than other countries considering the volatile global economic situation. Besides, exports may grow from the next quarter as inflation is easing, he added.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments