Export diversification still a far cry

Although the need to diversify Bangladesh's export basket has been a subject of great discussion for more than two decades, there has been little progress in this regard.

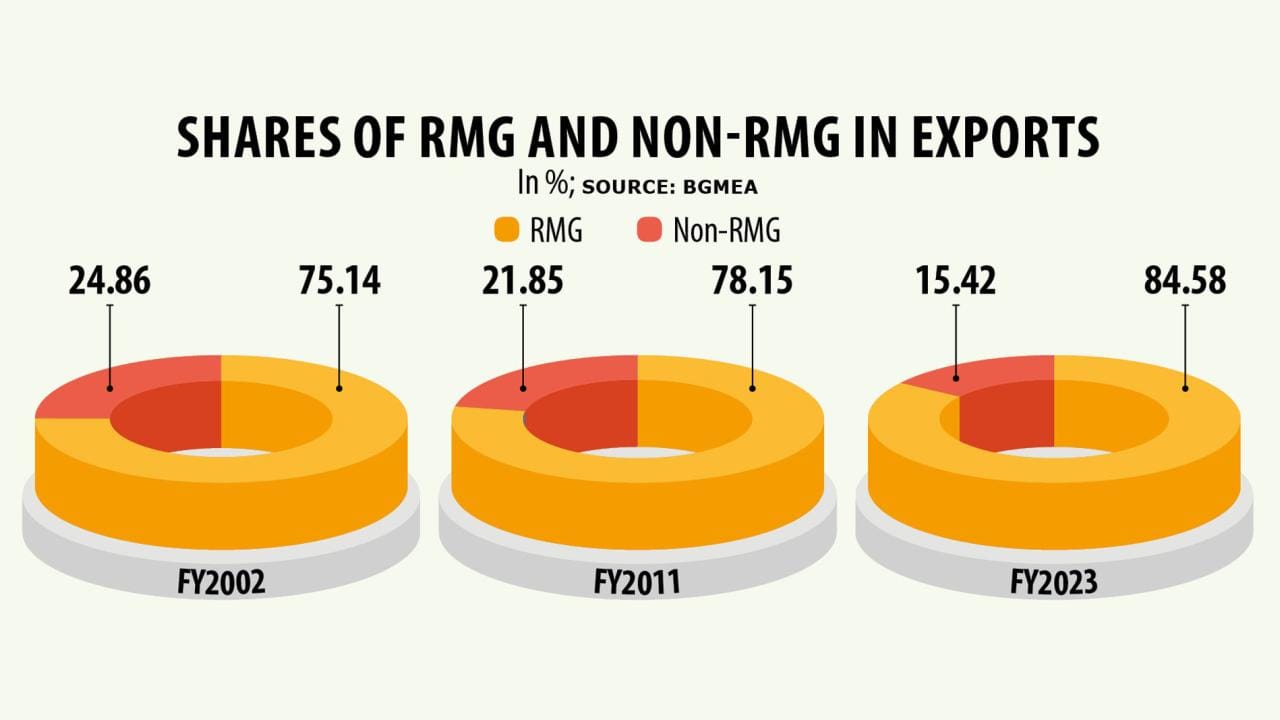

In fact, there has been no reflection of diversification in exports. On the contrary, readymade garments (RMG) continue to dominate, accounting for around four-fifths of all of Bangladesh's exports.

Though garment exports surged from $1.18 billion in the early 1990s to $47 billion by 2023, non-RMG exports grew from $811 million to just over $8 billion.

Between FY02 and FY23, exports soared by 828 percent from $5.9 billion to $55.55 billion, buoyed by a 925 percent rise in apparel exports.

However, despite the overall growth, the ratio of non-RMG exports to total exports declined from 24.86 percent in FY02 to 15.42 percent in FY23.

At present, Bangladesh's exports are largely made up of knitwear (44.6 percent) and woven garments (37.2 percent), with home textile (3.3 percent), footwear (2.3 percent), jute products (1.9 percent), and fish (1 percent) being other notable products.

Bangladesh's overwhelming dependence on RMG means that its export basket is among the world's least diversified.

Bangladesh's export basket is four times more concentrated than the developing-country average, according to a report by the Asian Development Bank (ADB) titled "Fostering Export Diversification in Bangladesh".

Along with product concentration, Bangladesh also suffers from a lack of export market diversification.

More than four-fifths of its exports are destined for North American and EU markets. Furthermore, Bangladesh's top-10 export destinations account for 72 percent of its total exports, while the corresponding figures for India and Sri Lanka are 52 percent and 64 percent.

Experts identified that policy and financing barriers and a lack of infrastructure development in the non-RMG sector had slowed export diversification.

"There were four major barriers in expansion of export diversification -- policy issues, financing barriers, lack of infrastructure, and weak bargaining power of non-RMG exporters," said Selim Raihan, executive director of the South Asian Network on Economic Modeling (SANEM).

He also said that non-RMG and RMG exporters cannot practically avail the same benefits.

As an example, he said RMG exporters can import capital machinery at zero duty while non-RMG exporters have to pay high tariffs to import necessary equipment.

Non-RMG exporters cannot even avail bonded warehouse facilities as easily as RMG exporters, which is a significant barrier to expediting export diversity, he said.

He also said the agro-processing sector had been failing to live up to its potential to increase exports due to a lack of infrastructure and proper government support.

Ferdaus Ara Begum, CEO of Business Initiative Leading Development (BUILD), said: "Export diversification has not happened because of several reasons. Even within the RMG sector, little diversification has happened."

Bangladesh exports only four to five products in the RMG sector, which has given buyers the chance to bargain for the prices of cotton garments, she said, adding: "Prices are falling lower and lower."

The need is to invest in manmade fibre, which requires huge investment and utility support, she said.

She added that the gas crisis, which has been affecting industries in recent years, was preventing industries from running operations smoothly. This poses a significant barrier to large investments in the country.

According to her, financing support is another issue as the export development fund is used by limited entrepreneurs.

CHALLENGES FROM LDC GRADUATION

Intensifying its diversification initiatives in preparation for the country's graduation from least-developed country (LDC) status in 2026 is imperative for a smooth transition.

As an LDC, Bangladesh enjoys unilateral trade preferences in markets in Canada, the EU and the UK. Such duty-free market access has endowed Bangladesh with a significant competitive edge.

In fact, more than 70 percent of the country's merchandise exports enjoy some LDC-specific trade preferences, which is far higher than other LDCs in Asia and the Pacific.

However, these benefits will cease after graduation unless they are extended.

For example, Bangladesh's duty-free access to the EU is set to expire in 2029 given the EU's additional 3-year transition period for graduating LDCs.

Post-graduation market access provisions in the EU are not yet settled, but under currently proposed terms, the average tariff rate facing Bangladesh's garment exports to the EU would increase from zero percent to about 12 percent.

At the same time, Bangladesh's exporters could see average tariffs on exports rising from zero to 17 percent in Canada, 16 percent in China, 8.7 percent in Japan, and 8.6 percent in India.

"The post-LDC scenario will be grave. After the reduction of cash incentives, exports of almost all sectors will decline," Ferdaus Ara cautioned.

A mismatch in export figures between the Bangladesh Bank, Export Promotion Bureau, and National Board of Revenue has worsened the situation, she added.

She said large investment in the export sector as well as utility, financing and tax policy support must be extended for export diversification.

"RMG is our success. We need to diversify the RMG products with a view to achieving at least $150 billion in exports from this sector by the next 5 years, which is possible," she said.

"We also need a clear sector-specific strategy."

Mustafizur Rahman, a distinguished fellow at the Centre for Policy Dialogue (CPD), said the RMG sector's faster rate of growth led to its dominance in Bangladesh's export basket.

However, he added that the growth of non-RMG sectors was very slow and, in some cases, even witnessed degrowth.

Rahman added that Bangladesh had received very little export-oriented foreign direct investment (FDI), which is one of the factors holding back export diversification. Another reason is that export-centric special economic zones are yet to be implemented.

He suggested mobilising export-oriented FDI and ensuring proper one-stop services would help export diversification efforts.

He added that a lack of technology and skilled human resources, particularly at the managerial level, was also restraining non-RMG sectors.

Although many studies have been conducted to identify the sectors with export diversification potential, practically the same sectors have been identified over time.

"The strategy of "picking winners" or targeting specific sectors for growth, such as the leather sector and information technology and IT-enabled services sector, has not succeeded as export targets have been consistently unmet," the ADB said.

"For the leather sector, the government had set an ambitious export target of $5 billion by 2021. Despite this focus and support, the sector's current exports are just above $1 billion, demonstrating the inability of the 'picking winners' strategy to produce the expected results."

M Masrur Reaz, chairman of the Policy Exchange of Bangladesh, said non-RMGs' share in Bangladesh's export basket had declined due to a lack of policy reforms.

"We need to bring the right support for those sectors to build up efficiency, including logistical support and adoption of technology," he said.

He also said an initiative to bring in export-oriented FDI is imperative because it is very difficult to diversify exports without foreign investment.

Another barrier to export diversification was posed by significant differences in the income tax rates between the RMG and non-RMG sectors.

The RMG sector has historically benefitted from a relatively lower corporate tax rate, ranging from 10 percent to 12 percent.

In contrast, non-RMG sectors, such as textiles, leather and leather goods, agro-processing and home textiles, have faced higher tax rates ranging from 15 percent to 30 percent.

Only recently, in FY23, a uniform income tax rate of 12 percent for both services and goods exports was introduced. This move is expected to rectify the existing bias in income tax rates for export-oriented industries.

In its paper, the ADB recommended addressing policy-induced disincentives against exports, boosting export market responsiveness and accelerating diversification.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments