Entrepreneurs stare at another blow as electricity tariff goes up

Entrepreneurs who have been finding it difficult to keep their head above water for the past two years owing to higher prices of energy, raw materials and massive depreciation of the local currency are staring at another blow as their cost of production is set to rise following the hike in electricity tariffs.

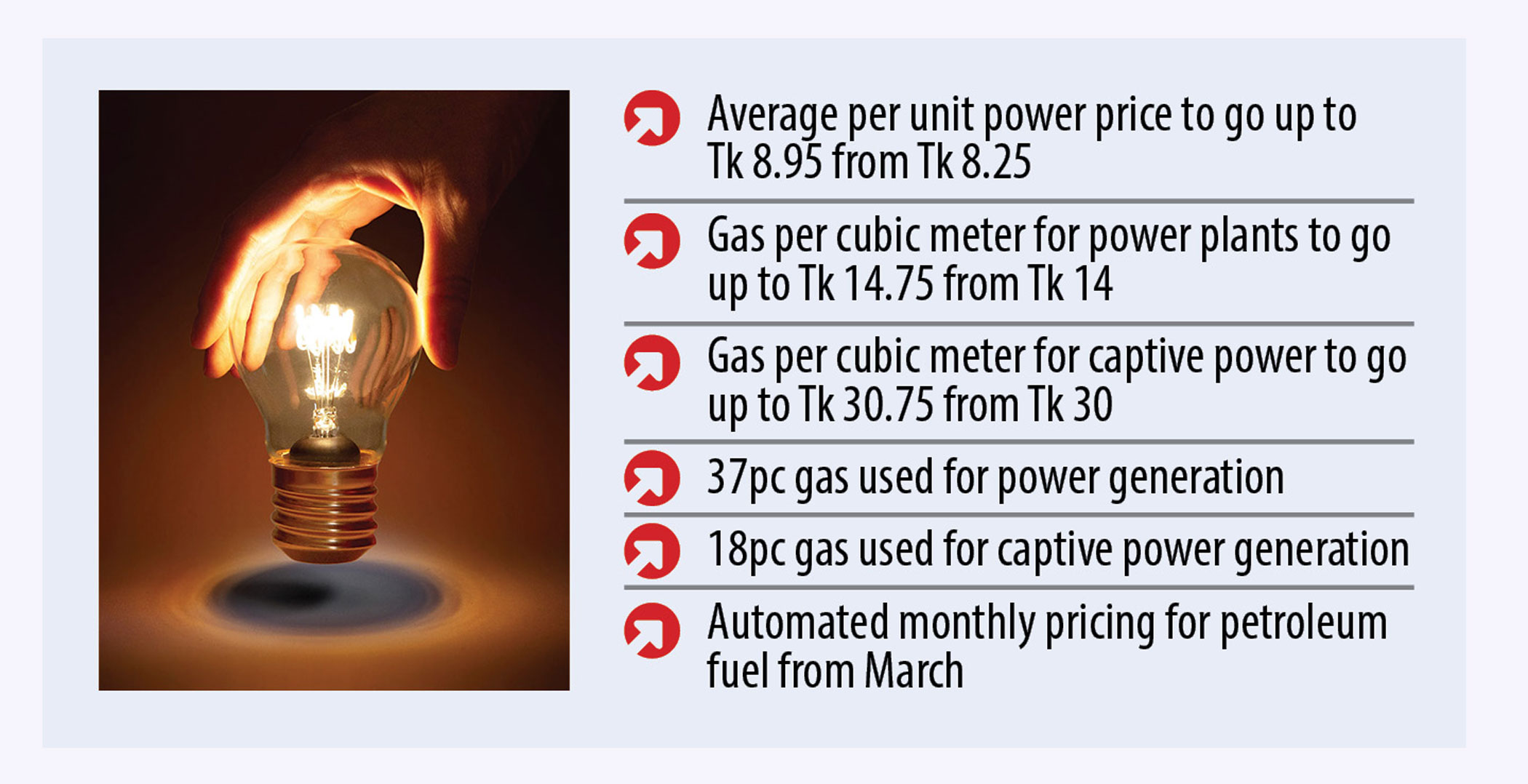

In order to lessen its subsidy burden, the government on Thursday increased electricity prices by Tk 0.70 a unit effective from February 1.

Earlier, last week, the authorities increased by Tk 0.75 per cubic metre the price of gas supplied to power plants and for captive power generation.

The spike in energy prices is not new for industries.

For example, electricity tariffs rose roughly 5 percent three times in the last financial year of 2022-23, resulting in a compound increase of around 15.7 percent. Likewise, the price of diesel rose 37 percent and furnace oil 41.4 percent.

Similarly, the price of gas for industries was hiked by 150 percent to 178 percent in FY23.

Besides, driven by a 25 percent fall in the price of the taka against the US dollar in the past couple of years, the overall raw materials price increased by 10 percent to 20 percent. And the shock from the deprecation shows no signs of easing as the foreign currency reserves have plummeted amid higher outflows of US dollars against lower inflows.

"Businesses are already facing hardship because of the higher cost of production and the existing business environment. The price hike of electricity will add insult to their injury," said Mohammad Hatem, executive president of the Bangladesh Knitwear Manufacturers and Exporters Association.

Despite the rising prices of gas and electricity, entrepreneurs are not getting a credible supply of power and an adequate pressure of natural gas, he alleged.

Industries and businesses face other major challenges as well.

For example, since the country is suffering from a dollar crisis, an adequate volume of US dollars is not available to open letters of credit (LCs).

The interest rate of bank loans has been on the rise after the central bank moved away from the 9 percent lending rate cap in July last year as part of its efforts to tame higher inflation. As a result, the cost of funds has gone up by as high as four percentage points in the first seven months of the current financial year of 2023-24, a development that will raise the expenses for businesses and industries.

The apparel sector has also seen an upward revision in the wages and salaries of workers.

"Under the circumstances, the higher energy price will add to costs and reduce the competitiveness of exporters. If export earnings fall, the economy will also feel the pinch," Hatem said.

The spiraled cost of production hit businesses in FY23, which ended in June.

For instance, of the 158 listed companies that published financial reports for the last financial year, 99 companies, or 62 percent of the total, saw a drop in profits. Most of the firms have blamed the higher energy costs, an elevated level of raw material prices and the currency depreciation for the hit to the profit.

"The industrial sector is not getting enough gas. Still, the government is raising its price," said Mohammad Ali Khokon, president of the Bangladesh Textile Mills Association.

"Why are you increasing the price if you can't supply enough gas?" he questioned.

"The investment environment is deteriorating day by day."

The entrepreneur said loans from the central bank's Export Development Fund (EDF) have been made costlier as the BB has raised the interest rate of the scheme, which relies on the reserves.

Established in 1989, the EDF helps manufacturer-exporters access the programme for input procurements from international markets.

"The US dollar is costlier when exporters need to import raw materials but its price is lower when they encash them," Khokon said.

Banks buy each greenback for Tk 110.5 from exporters and sell it to importers for Tk 111.

"How will industries survive in this situation?" he said.

The government is also going to introduce an automatic fuel pricing mechanism to comply with one of the conditions of the $4.7 billion loans given by the International Monetary Fund (IMF). The IMF suggests the adoption of the automatic pricing to curb subsidies enjoyed by people irrespective of their incomes and ensure targeted support for the poor.

This means if the prices go up in the international market, they will automatically increase in the local market and vice versa.

But Anwar-ul Alam Chowdhury, a former president of the Bangladesh Garments Manufacturers and Exporters Association, questioned whether the price will fall when it comes down in the international market.

"The experience in Bangladesh is different," he said, pointing out that the prices don't fall in Bangladesh immediately after they decline in global markets whereas any upward adjustments take place instantly.

He also said it has to be seen whether local companies can cope with an automatic price adjustment of energy.

Chowdhury said the cost of production has already risen for industries whereas the demand for goods in the local market fell amid escalated consumer prices, which rose to a 12-year high in FY23.

Inflation has been running high at more than 9 percent since March last year as well.

"Due to higher inflationary pressures, people are spending less on non-food items. If the cost of living goes up further, retail sales will drop too," Chowdhury said.

He said the Bangladesh Bank has taken a contractionary monetary policy stance to rein in inflation and made funds costlier.

"Banks are investing in treasury bonds instead of lending to industries as the yields against the former are higher. Under the circumstances, it will be a big challenge for many companies to survive."

Economists say the government has no other option but to reduce subsidies as tax collections have remained low while expenditures are climbing. So, they recommend businesses and industries enhance productivity and competitiveness.

"Owing to the price hike of electricity, the production cost of the manufacturing sector will rise. Therefore, it may impact the price level and stoke inflationary pressures," said MK Mujeri, a former chief economist of the central bank.

He said the government has a logic behind the price spike since the subsidy spending has gone up to a significant level whereas revenue receipts have remained low, hurting development expenditures.

The former director-general of the Bangladesh Institute of Development Studies says the electricity sector requires a huge subsidy due to some wrong policy decisions of the government.

He said significant capacity payments made to private power producers and allowing rental and quick rental power plants to operate for a long time have raised the overall costs of electricity generation.

According to the economist, the price adjustment should be slow so that people don't feel much pains.

There are allegations that the government has to spend more in implementing development projects owing to graft, Mujeri said.

"People are suffering for the wrong policies of the government and corruption."

He urged the government to put in place proper policies and curb corruption.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments