DSE key index hits 16-month high as investor optimism climbs

Shares on the Dhaka Stock Exchange (DSE) rose yesterday as investors continued to maintain a high rate of trade over the past 10 days with hopes of a further increase in the stock prices.

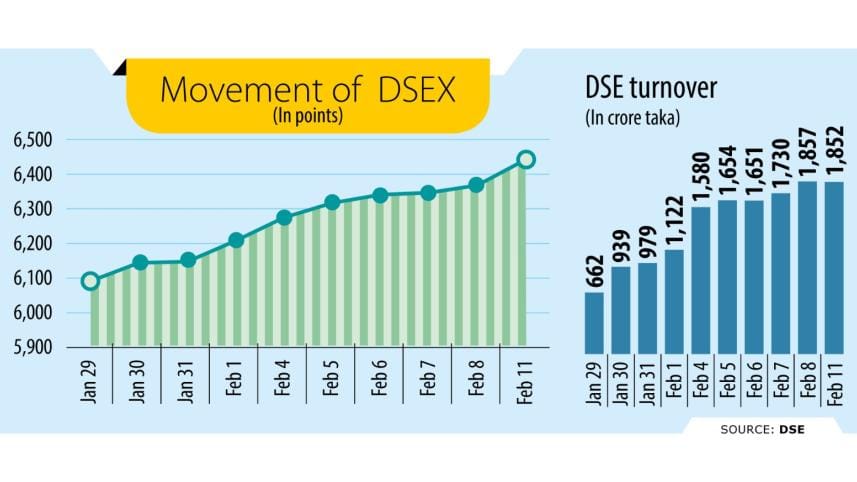

The DSEX, the benchmark index of the DSE, went up by 73 points, or 1.16 percent, from that on the last trading day to close at 6,447 yesterday.

With that, the index has risen for 10 consecutive trading days, reaching a 16-month high.

The last time it was at this level was on October 16, 2022, when it had reached 6,478 points.

The DSE 30 Index, which comprises blue-chip companies, rose 21 points to finish at 2,159 whereas the DSE Shariah Index (DSES) advanced 10 points to 1,398.

Turnover slightly dipped to Tk 1,853 crore where it was Tk 1,858 crore in the preceding session.

A large number of retail investors increased their participation in the market with hopes that many stocks will rise in the coming month, said a stock broker.

However, most investors are rushing for stocks based on rumours instead of doing their research and acquiring stocks of companies with good performance records, he said.

As a result, most stocks of companies with good performance records are rising in a sluggish manner, although some others are rising continuously.

On the other hand, many stock investors hope for banking companies to disclose a better performance for 2023 and this was why they were buying associated stocks, he added.

The banking sector is going to announce dividends soon, so many investors are pouring their money into lucrative banks, said a merchant banker.

Listed multinational companies are also announcing their financials and dividends. So, some institutional investors are rearranging their investments taking into consideration the performances of the companies, he added.

Among the major sectors, banking stocks rose the highest (4.29 percent) followed by non-bank financial institutions (4 percent) while the engineering sector faced the biggest erosion (1.45 percent).

Of the issues that were traded at the premier bourse of the country, 165 advanced, 196 declined and 33 closed unchanged.

Shares of the South Bangla Agriculture & Commerce Bank topped the gainers' list with a rise of 10 percent, followed by Social Islami Bank (9.90 percent), Mithun Knitting and Dyeing (9.89 percent), HR Textile (9.88 percent), Aramit Cement (9.81 percent), Prime Finance & Investment (9.80 percent), Intraco Refueling Station (9.78 percent), National Bank (9.72 percent), Best Holdings (9.71 percent), and Sikder Insurance Company (9.70 percent).

Shyampur Sugar Mills lost the most (8.74 percent) followed by Renwick Jajneswar & Co (Bd) (5.70 percent), Intech (5.61 percent), Beach Hatchery (5.52 percent), Bangladesh Industrial Financial Company (5.43 percent), Renata (5.40 percent), Central Pharmaceuticals (5.40 percent) and Olympic Accessories (5.18 percent).

Chittagong Stock Exchange also rose yesterday. The Caspi, the broad index of the port city bourse, surged 309 points, or 1.69 percent, to 18,605.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments