Dozens of zombie firms still trading as if nothing is wrong

- Dozens languish in DSE junk category

- Loss‑makers trade despite years of deficits

- Analysts urge delisting, regulators resist cleanup

- Investors left exposed to speculative trading

Nearly four dozen companies have been languishing in the junk category of the Dhaka Stock Exchange (DSE) for at least five years, yet their shares continue to trade on the country's main market and sometimes even appear among the top gainers.

Year after year, these firms fail to post profits or pay dividends, while many do not hold annual general meetings on time. These are the criteria that place companies in the Z category, known as the junk group.

In theory, Z-category stocks should warn investors. In practice, the label does little to scare away trading, and the shares of such firms continue to change hands.

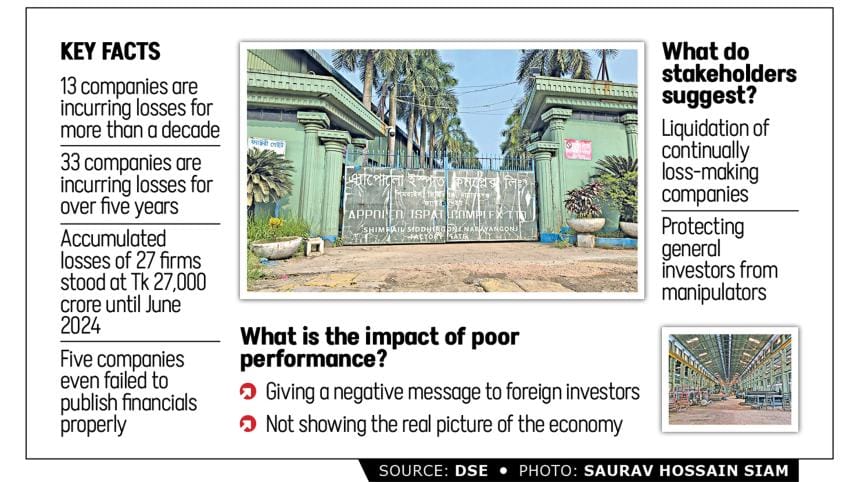

Analysts say allowing companies that owe more than they have is like "letting zombies roam the market". They argue that these firms should either be delisted or liquidated so that investors can get back some of their hard-earned money.

Regulators, however, have long opposed such a market clean-up. Both the Bangladesh Securities and Exchange Commission (BSEC) and the DSE maintain that investors must take responsibility for their own choices. If investors wish to trade speculative stocks, the regulators say, they are free to do so.

Delisting removes a company's shares from public trading. Shareholders technically still hold their stocks and can sell them privately on the over-the-counter (OTC) market, which has less liquidity and a higher risk of loss.

According to stock exchange rules, a company may be delisted if it fails to hold annual meetings for three years, declares no dividend for five years, or remains out of production for three years.

Of the nearly four dozen underperforming firms, at least 13 have been in the red for a decade or more.

These include Meghna Condensed Milk, Meghna Pet Industries, Peoples Leasing, Savar Refractories, Shyampur Sugar Mills, Usmania Glass Sheet Factory, Zeal Bangla Sugar Mills, ICB Islamic Bank, Jute Spinners, Bangladesh Industrial Finance Company, Bangladesh Welding Industries, BD Services and Atlas Bangladesh.

Another 33 have been losing money for at least five years. They include Appollo Ispat, Central Pharmaceuticals, Familytex BD, Keya Cosmetics, Renwick Jajneswar, Ring Shine Textiles, RSRM Steel, Shurwid Industries, Standard Ceramics, Yeakin Polymer, Zaheen Spinning Mills and Zahintex Industries.

The accumulated loss by 27 of the firms stood at around Tk 27,000 crore until June 2024, while data of others were not available.

"The stock market has hundreds of companies listed, but institutional investors can invest in only a few because there is a huge lack of investible securities," said Asif Khan, president of the CFA Society Bangladesh.

He said if the regulator realises that these firms have no chance of being a going concern, they should be liquidated and delisted.

A going concern is a company capable of continuing operations into the foreseeable future. When a firm repeatedly incurs losses, fails to pay dividends and has negative net worth, it ceases to qualify.

In most markets, such companies are restructured or wound up, their assets sold and debts settled through liquidation.

A couple of years ago, the BSEC restructured the boards of several loss-making ventures in hopes of revival. None has returned to profit. Many have stopped releasing financial data altogether; some do not even maintain functioning websites.

Atlas Bangladesh has not updated its contact details on the DSE website since 2021.

Similarly, BD Welding, Meghna Pet Industries and Meghna Condensed Milk list no contact persons, while the company secretary of Savar Refractories did not respond to calls from The Daily Star.

Attempts to reach state-run firms on the red list, including Zeal Bangla and Shyampur Sugar Mills, also failed.

The remaining companies are either weak banks or non-bank financial institutions facing liquidation. Despite repeated losses, shares of some of these firms occasionally post sharp price jumps, a sign of speculative trading rather than genuine investor confidence.

"These toxic stocks should have been delisted years ago," said Saiful Islam, president of the DSE Brokers Association. "But the regulators assume their only responsibility is to move a failing company into the Z category and leave it there."

"That might work in developed nations. But in a market where many investors have limited financial literacy, that is not enough," he added.

Islam believes the BSEC and DSE should take responsibility for cleaning up the market by forcing chronic loss-makers to exit.

"They can give these firms time to explain their situation. But if there's no chance of revival, they must be delisted," he said. "Otherwise, the losses of these rotten shares fall on ordinary investors."

Bangladesh's stock exchanges list about 400 companies, yet the pool of healthy, investible securities remains small. Institutional investors, such as mutual funds and insurers, have limited options, while retail investors chase short-term gains in speculative stocks.

Earlier this year, the BSEC revised its Z-category criteria, reaffirming that firms failing to declare dividends for two years, missing annual meetings or showing negative retained earnings greater than their paid-up capital will be downgraded.

In May, it ordered all Z-category firms to appoint independent directors to improve governance, but the move produced little effect.

Delisting remains a sensitive issue. Although the DSE has the authority to delist inactive or non-compliant companies, the process is slow and politically charged.

Abul Kalam, spokesperson of the BSEC, said the commission would support any DSE action against such firms. "The DSE, as the primary regulator, can move against these loss-making companies. If they do, we will cooperate," he said.

Contacted, DSE Chairman Mominul Islam said delisting ultimately harms general investors, so the exchange was not considering it for now.

"Currently, the Dhaka bourse is not entitled to liquidate a firm. We are trying to bring changes to the law so that the DSE can do so," he said.

Islam added that the exchange was seeking legal advice from experts and studying regulatory frameworks in other countries.

"If any company fails due to irregularities by its directors and sponsors, in which investors eventually bear the brunt, in such cases, we also want scope in the law to penalise the top brass," Islam added.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments