Brac Bank plans to double business by 2025

Brac Bank Ltd has planned to double its business by 2025 with a view to catering banking services to people from all walks of life, said its managing director, Selim RF Hussain.

The lender's market share in the country's banking sector was 2.2 per cent in 2021, which will be widened to 4.5 per cent by 2025, he said in an interview with The Daily Star last week.

"We took the plan in 2021, and it is now being implemented successfully as the lender is expanding its business at a fast pace," he said.

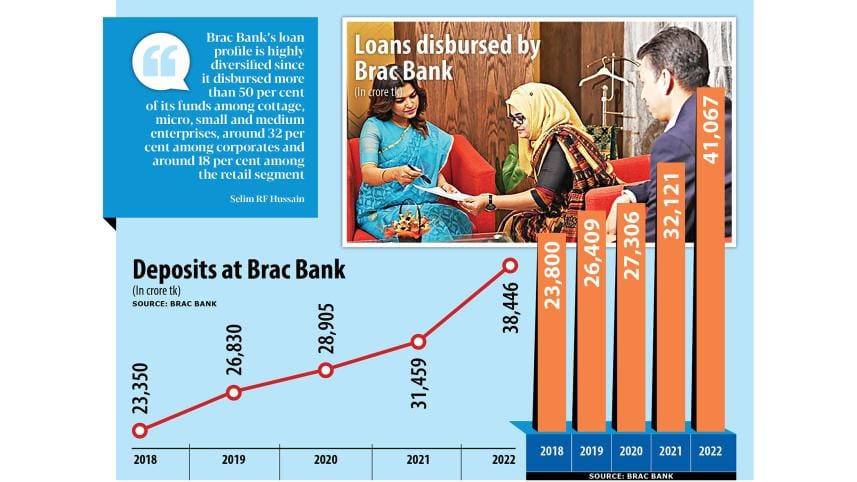

For instance, the lender achieved a loan growth of 28 per cent last year compared to around 14 per cent registered by the banking sector.

Meanwhile, it also secured a deposit growth of 24 per cent in contrast to 7 per cent managed by all banks on an average.

It also achieved a 32 per cent growth in its net profit after tax for 2022 despite various challenges in the market.

Its net profit stood at Tk 576 crore last year whereas it was Tk 555 crore in 2021.

The bank took a medium-term plan in 2021 for the next four years, under which it decided to grow its balance sheet on an average of 22 per cent each year.

"The bank took the decision to grow in an aggressive manner at a time when the country's banking sector was under a stressful situation," said Hussain.

"Our financial health was better than many others during the period. Moreover, we prepared our human resources and digital and other platforms between 2015 and 2020 to commence our journey," he said.

This did not come about overnight as the bank put in tremendous efforts to complete the associated fieldwork between 2015 and 2020, he said.

The lender's loan profile is highly diversified since it disbursed more than 50 per cent of its funds among cottage, micro, small and medium enterprises, around 32 per cent among corporates and around 18 per cent among the retail segment, he said.

"No bank in Bangladesh has managed to secure such diversity. This is why the bank is free from credit concentration risk," said Hussain, who joined Brac Bank Ltd in November 2015.

Corporate governance is the main strength of the lender and its board of directors has played a pivotal role in ensuring that, he said, adding that no director in the bank has any ownership of the lender.

"A powerful relationship between the management and the board is the major driver of the business expansion of the lender. The board always empowers the management to take decisions independently," he said.

Default loan is now a major challenge for the banking sector but only 3.7 per cent of the lender's total loans were non-performing loans (NPLs) as of March this year, much lower than the banking sector's average default loan ratio of 8.8 per cent.

"We are managing our NPLs efficiently as the bank usually recovers 30 per cent of its bad debts each year," said Hussain.

He thinks that the government should invest more to strengthen the country's legal framework to tackle the challenges stemming from defaulted loans.

The bank has been investing in digital platforms substantially for the last five to six years and it has started to get benefits from its efforts, he said.

The lender settled around 17 per cent to 18 per cent of transactions digitally just before the pandemic arose but it is now close to 75 per cent, said Hussain.

It has already invested a large amount of funds to ensure cyber security to run its transactions smoothly, he said, adding that the bank has appointed 25 ethical hackers to secure its digital and online banking.

"We are now pushing more for digital banking. But it is not possible to settle all transactions digitally soon," he said.

"So, we are now giving importance to expanding both our physical and digital networks in tandem to bring the commoners under the formal banking sector," said Hussain.

The bank will set up 500 sub-branches within the next three to four years in rural areas, said Hussain, who is also the chairman of the Association of Bankers, Bangladesh, a platform of the banking industry's chief executives.

The bank now has 40 sub-branches.

It is important to set up such physical infrastructures in villages as the people in rural areas are not used to digital banking, he said.

He also touched upon some pressing issues in the banking sector.

The recent downgrading of the sovereign credit rating of Bangladesh will create difficulties for banks to do their business, according to Hussain.

US-based global credit rating agency Moody's Investors Service yesterday downgraded Bangladesh's sovereign rating by one notch to B1 from Ba3.

This is the first time the country's rating has been downgraded since the agency started rating the nation in 2010.

Local banks will face higher fees and commissions to conduct foreign exchange-related banking with corresponding foreign banks, he said.

Foreign banks may also reduce credit limits for local banks due to the downgrade, he said.

Import payments have gone down in recent months, which has already helped ease the stress faced by the foreign exchange market, said Hussain.

"But the country needs much more imports to ensure its desired GDP growth. Although the liquidity position in the foreign exchange market has improved significantly in recent months, it is still under lots of stress," he said.

The economy has grown by a massive extent in recent years, which is why the country's dependence on imports has increased substantially, he said.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments