Black money holders get amnesty

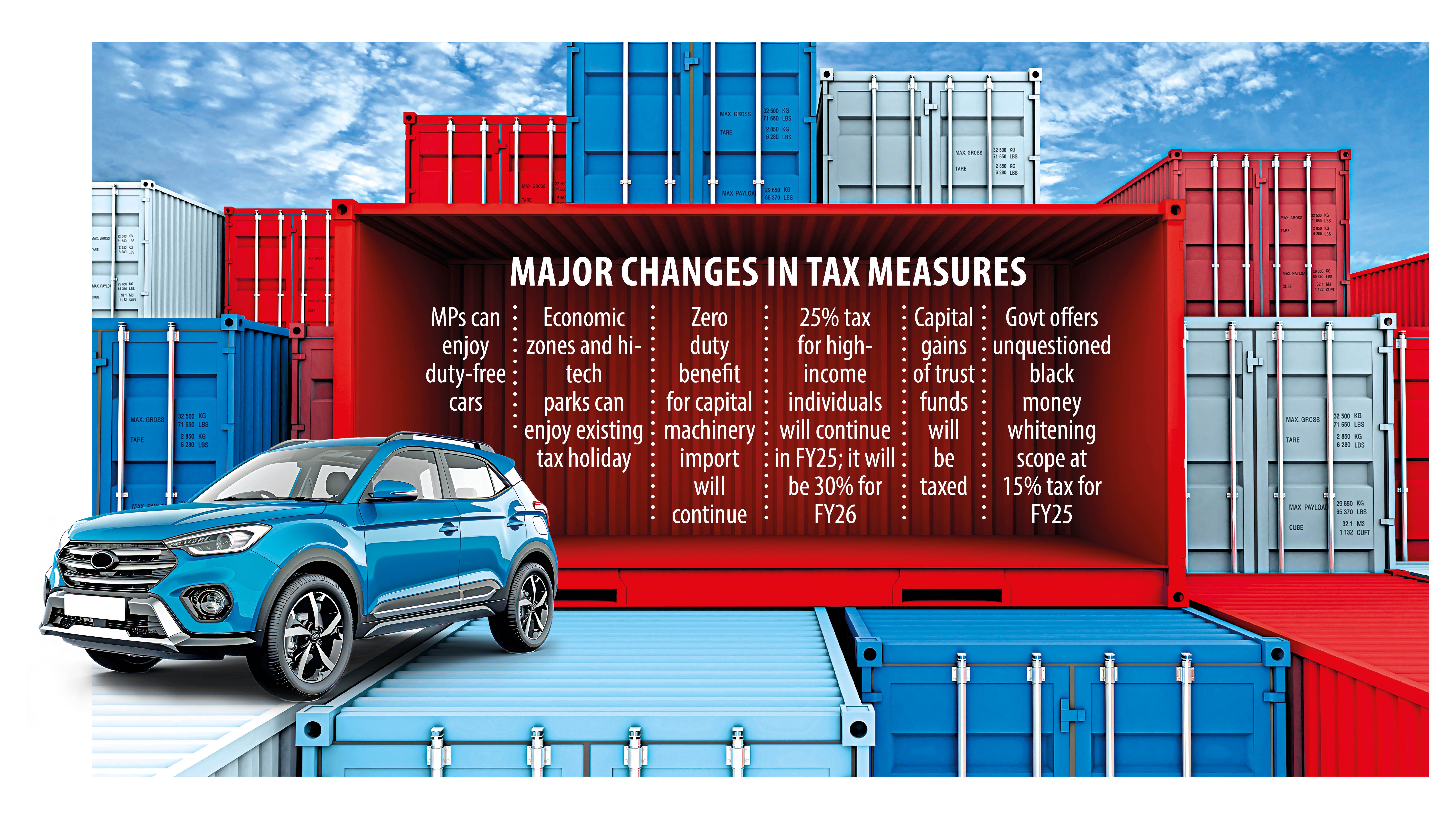

Parliament yesterday approved a provision that will allow black money holders to legalise their undisclosed wealth without any scrutiny by paying a 15 percent tax, disregarding widespread condemnation from various quarters.

The provision will take effect in the upcoming fiscal year that begins on July 1.

Think-tanks, watchdogs, chambers and several lawmakers criticised the provision, terming it unethical, unjust and unacceptable.

"This represents sheer insensitiveness of the members of parliament to growing public concerns about widening floodgates for corruption, illegality and corruption, which this provision facilitates," said Iftekharuzzaman, executive director of Transparency International Bangladesh.

The move also undermines Article 20(2) of the constitution that makes black money clearly illegal, he said.

It is also discriminatory against honest income earners, who have to pay up to 30 percent tax while black money holders are being rewarded instead of being subjected to accountability and getting the provision to pay only 15 percent, he said.

"In effect, the government is inviting people at large to be corrupt, immoral and dishonest to earn black money throughout the year with the guarantee that they will be rewarded and given impunity for earning any amount of income disproportionate to the legal source. Unfortunately, the state is being pushed further down the road to kleptocracy," Iftekharuzzaman added.

The provision is unethical and insulting to honest taxpayers, said Ahsan H Mansur, executive director of the Policy Research Institute of Bangladesh.

"I don't know who will benefit from such a move. But certainly, they are powerful and they are people in high positions. The interest of the country has certainly not been considered here."

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments