26 lakh insurance policies discontinued in 14 years

More than 26 lakh insurance policies have lapsed in Bangladesh in the last 14 years owing to a raft of factors including the worsening of financial health of clients, a lack of awareness among them, and agents' tendency not to explain product features properly while selling them.

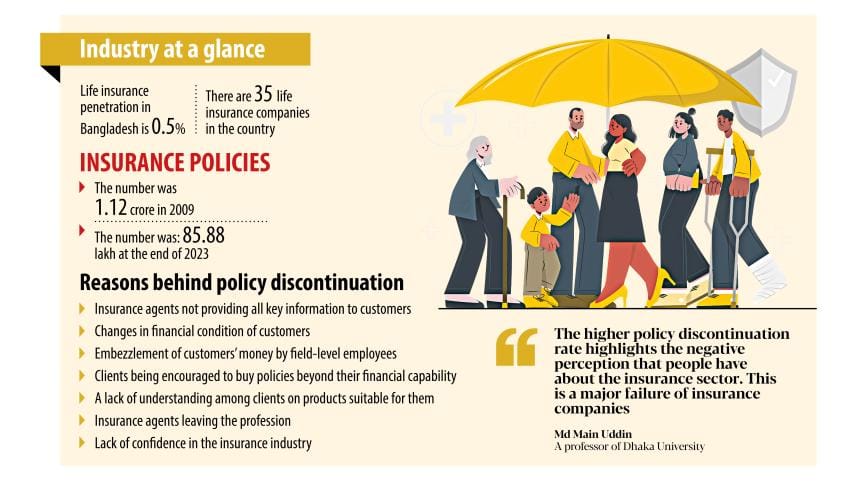

In 2009, the total number of policies was nearly 1.12 crore and it fell to 85.88 lakh in 2023, figures from the Insurance Development and Regulatory Authority (Idra) showed.

The lapse is the rate at which policyholders fail to pay their premiums on time, leading to cancellations of insurance coverage.

About 50 percent of life insurance policyholders in Bangladesh don't pay premiums after the first year.

The lapse rate is 10 percent in India. Globally, 96 to 98 percent policies are continued, said SM Ibrahim Hossain, director of the Bangladesh Insurance Academy, a state-run institute imparting training to insurance professionals.

The reasons for the higher lapse rate include purchasing of higher value plans compared to the affordability of clients and agents' bent not to furnish potential customers with key information that may lead to non-subscription of the products in the first place, according to Mohammad Jainul Bari, chairman of the Idra.

"Many a time, agents don't share rules when they sell policies. Agents may also sell a product that may not suit the requirements of the customer or he or she may not have the financial capacity to continue it."

There are some other reasons for policy discontinuation and one of them is fund embezzlement by agents.

According to Hossain, non-payment of premiums and the loss of income sources also play a role.

"In many cases, policy-holders pay the premiums to someone else who does not deposit the money within the stipulated period or does not deposit the fund at all."

He said agents sometimes switch professions and insurers close branches. Natural calamities such as floods, droughts and cyclones also caused the deterioration of the financial capacity of policy-holders.

An Idra official, on condition of anonymity, said that there are some managing directors of insurance companies who influence their agents so that policies are discontinued.

"If the policy is not renewed at the end of the first year, the companies will not have to settle the claims."

Ala Ahmad, chief executive officer of MetLife Bangladesh, the lone international life insurer in the country, said lapsed policies are bad for both customers and insurers.

"For customers, they mean losing the safety net that could protect them against unforeseen events. For insurers, they lead to lost revenue and negatively impacting financial stability and customer relationships."

Oftentimes, lapses occur due to a lack of awareness of the importance of regularly paying premiums, he said.

Ahmad said MetLife has taken initiatives to help customers remain fully protected throughout their insurance tenure.

These include after-sales proactive briefing calls to customers, SMS-based reminders, enhancing digital premium payment channels and training agents so that they can educate customers to keep their policies active, he added.

Md Jalalul Azim, managing director of Pragati Life Insurance Ltd, said when he joined the company in 2013, some 20 percent of the policies continued after 25 months. This has improved to 49 percent now.

He said the company is now focused on selling the right kind of products that customers need. "Thus, the discontinuation rate has dropped."

Azim said the use of digital technologies in collecting premiums is increasingly offering convenience to customers.

Pragati Life Insurance plans to raise the policy continuation rate to 60 percent within three years.

Md Main Uddin, a professor of the department of banking and insurance at the University of Dhaka, thinks the higher policy discontinuation rate highlights the negative perception that people have about the insurance sector.

"This is a major failure of insurance companies."

Agents receive a higher percentage of commission on the premiums paid in the first year, so they are more interested in selling as many products as they can.

Currently, agents get about 35 percent commissions on the premiums in the first year, 10 percent in the second year and 5 percent in each of the subsequent years before a policy becomes mature.

Therefore, Prof Main said, the rate of commission should be revised so that agents are more attentive towards policy renewal.

Jainul Bari said the Idra has decided to revise the commission rate within a month.

In 2023, ten companies with a high lapse rate were asked to raise it to 60 percent.

"We have not received the annual reports of the companies yet. After getting the reports, we will understand how much progress they have made," Bari added.

Some companies have been fined for their failure to increase the policy continuation rate and show-cause notices have been issued, he said.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments