10 listed NBFIs leave investors in dark

Seven months have passed since the world bid adieu to 2022, but almost half of the listed non-bank financial institutions (NBFIs) in Bangladesh have not published their financial statements for the year, breaching securities rules.

As a result, hundreds of thousands of general investors who are holding the stocks of the companies have remained in the dark about how the non-banks fared in the year.

NBFIs' financial year runs from January through December.

According to listing regulations, the annual financial statements of listed companies, excluding mutual funds, have to be audited within 120 days after the issuers' financial year ends.

And the report must be published within 14 days of the audit. This means NBFIs are compelled to bring out their yearly statements by the middle of May.

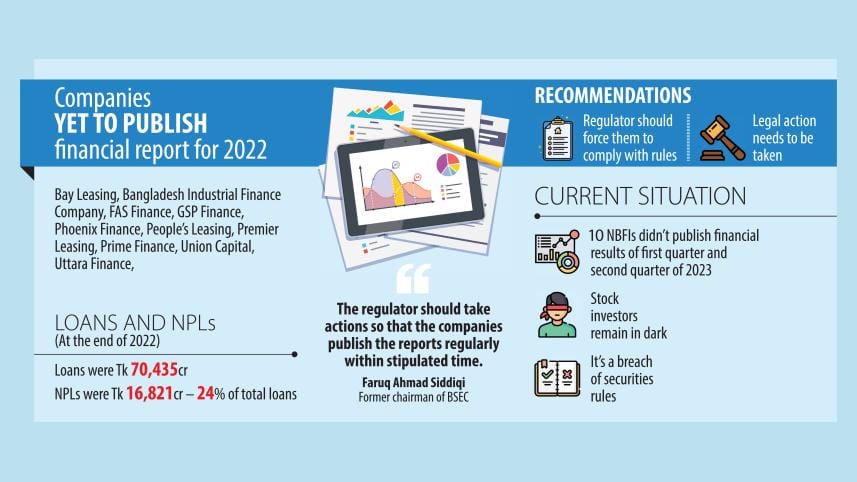

At present, 23 NBFIs are listed on the Dhaka Stock Exchange (DSE). Of them, 10 are yet to publish the financial reports within the stipulated date.

The companies were Bay Leasing, Bangladesh Industrial Finance Company, FAS Finance, GSP Finance, Phoenix Finance, People's Leasing, Premier Leasing, Prime Finance, Union Capital, and Uttara Finance.

The 12 companies that released the financial reports for 2022 on time also published the reports for the first and second quarters of 2023. The 10 NBFIs have failed to make financial disclosures for the first two quarters as well.

Faruq Ahmad Siddiqi, a former chairman of the Bangladesh Securities and Exchange Commission (BSEC), said: "If companies don't publish reports on a regular basis, stock investors remain in the dark."

"NBFIs should publish financial reports on time, no matter whether their financial situation is good or bad or whether they face higher non-performing loans or heavy losses."

"Investors have the right to know the situation of the companies," he said, urging the BSEC to initiate measures to this effect.

Non-compliance regarding the filing of financial reports was mostly seen at loss-incurring NBFIs or the companies that were the victim of irregularities.

The companies were Bay Leasing, Bangladesh Industrial Finance Company, FAS Finance, GSP Finance, Phoenix Finance, People's Leasing, Premier Leasing, Prime Finance, Union Capital, and Uttara Finance.

Of them, GSP Finance made a profit as per its updated data while the rest incurred losses, DSE data showed.

Most of the NBFIs that have not published financial reports are mainly struggling with mammoth NPLs and irregularities.

NPLs in the NBFI sector stood at Tk 16,821 crore in 2022, which accounted for nearly a quarter of the total outstanding funds disbursed by non-banks, BB data showed.

Of the 10 non-compliant NBFIs, only Union Capital gave reasons for the delay in making the financial reports for 2022 public.

The non-bank has requested the BB to reconsider its decision on charging interest against the loans extended to Unicap Investments Limited.

Union Capital has extended a loan to its subsidiary. However, the subsidiary can't charge the interest on the margin loans as clients are facing huge losses, the NBFI argued.

So, if Union Capital levied interest, the subsidiary would have incurred a substantial amount of loss, which will ultimately worsen the financial health of the group.

Since the matter has not been settled yet, the NBFI is not in a position to finalise the audited financial statements for 2022.

"We have received the BB's decision, so we will take the next step following the board's instruction," said Union Capital's Company Secretary Md Abdul Hannan. He gave no details.

Union Capital's NPL was Tk 595 crore in March this year.

The highest defaulted loan of Tk 3,755 crore was held by International Leasing and Financial Services.

It was Tk 1,649 crore for FAS Finance & Investment, Tk 1,013 crore for Uttara Finance, Tk 907 crore for People's Leasing, Tk 967 crore for Phoenix Finance, and Tk 755 crore for Bangladesh Industrial Finance Company, according to central bank data.

Md Armia Fakir, company secretary of People's Leasing, said the High Court ordered the company to liquidate.

Later, it was allowed to resume the business. In the last three years, the board has been restructured a number of times.

"The company is going through a transformation. So, the audit report has not been published," he said.

Md Zahid Mahmud, company secretary of FAS Finance & Investment, says the financial reports have not been published as audit activities have not been completed yet.

Md Ramzan Hossain, company secretary of Fareast Finance, said the financial report for 2022 has been audited, adopted and sent to the regulators.

"It will be published on the website of the company and in the newspapers soon."

A top official of the BSEC says most NBFIs have sought time extensions to submit financial reports.

"On the other hand, some companies are struggling with higher NPLs and losses. We are trying to speed up the process."

Both Subash Chandra Moulick, company secretary of Premier Leasing, and Mohammad Zaman, company secretary of Prime Finance, said the companies have been given additional time by the central bank.

Md Sayadur Rahman, president of the Bangladesh Merchant Bankers Association, said though investors are aware that most of the NBFIs are facing challenges stemming from higher bad loans, they want to know the real scenario by looking at the financial statements.

"If companies don't publish financial reports, investors remain in the dark and face problems in taking investment decisions."

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments