Solid trust, fair treatment key to private investment

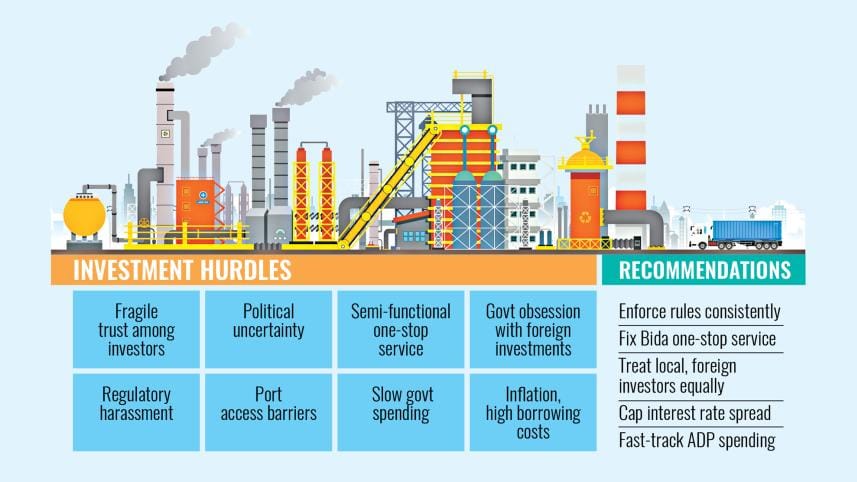

The country's private sector remains hamstrung by red tape, political uncertainty, and rising costs, all of which pose a serious threat to economic progress, according to Mohammed Amirul Haque, founding managing director and chief executive officer of Premier Cement Mills Limited.

In an interview with The Daily Star, Haque praised the government for its efforts to promote investment and improve the business climate, but he questioned the genuineness of those efforts.

He congratulated the Bangladesh Investment Development Authority (Bida) for hosting an international summit and events, and for drawing global interest in the country's economy.

Even so, he questioned the balance of focus, saying that local entrepreneurs are often sidelined in favour of foreign investors.

"Other than big names like Elon Musk and a few companies, no one significant has entered the market yet," said the cement maker. "There were foreign investment commitments of over Tk 3,000 crore, but they have not materialised fully."

Speaking on the hurdles faced by local investors, the businessman shared his own long wait for permission to use land bought in Munshiganj for industrial purposes. Haque said the lack of political connections had "stalled" the process.

"Unless you have connections, you cannot get things done," he said.

"In other districts like Khulna or Mongla, I faced no problems getting land for industrial use. But in Munshiganj, there are obstacles because I do not have the political link. Either the government should allocate land for industry directly or make the process genuinely transparent so people without political links can proceed."

Turning to the broader investment climate, the Premier Cement Mills CEO said political instability and uncertainty continue to hold back large-scale projects. "In my view, there has been no significant new investment recently. Investors need political stability, and until we have that, no large-scale new investment will come."

He also pointed to a history of "selective crackdowns" on businesses and individuals, which he believes have shaken confidence in the system.

"Even when the government takes action against individuals or businesses, one must ask: Why only now? Why were actions delayed for years? If the government has rules and norms, they should enforce them consistently, not selectively."

The businessman was critical of the role of regulatory bodies such as the Registrar of Joint Stock Companies and Firms (RJSC).

"There are allegations of harassment against RJSC by corporate houses and businessmen while renewing licences."

Haque alleged that the RJSC runs with little oversight. "Though it is under the Ministry of Commerce, they do not listen to anyone and run their own way. This lack of accountability is problematic."

He also criticised access restrictions at trade-related offices like the Chittagong Port Authority, which he said should be far more open to businesspeople.

"It is supposed to be a commercial office, but you need special permission to enter, as if it is the secretariat, or the President's House, or the Prime Minister's Office. That is not how a commercial office should run."

On a separate note, Haque said that the government should do more to revive struggling factories instead of focusing only on new investments.

"Many factories already have infrastructure like power and utilities. Revitalising those would be much easier than building new factories from scratch, especially since there is often no fresh gas or basic service lines available for new industrial setups."

According to the cement manufacturer, the sluggish implementation of the Annual Development Programme (ADP) last year had a direct impact on key construction input sectors.

On top of that, high inflation for around three years has reduced construction demand.

Haque said although incomes have risen in some areas, the lower middle-income group is under intense inflationary pressure.

"Daily essentials are indeed getting expensive. But the lower middle-income groups with fixed salaries are suffering because their incomes are not rising to match expenses."

Amid this lacklustre demand for construction materials, he said high interest rates are making industrial growth more difficult.

"The central bank adopted a contractionary monetary policy to control inflation, but it ended up benefiting banks while hurting industries. Banks are making good profits, but industries are suffering because borrowing costs are too high."

To ease the burden on businesses, he urged the Bangladesh Bank to limit the interest rate spread.

"The spread between lending and deposit rates should not cross 3 percent in any case. That is the only way to keep the cost of doing business manageable," Haque added.

Above all, restoring trust and ensuring a conducive business climate are essential for attracting both local and foreign investment.

"It all comes down to trust. Without trust, the private sector will not invest. Businesspeople do not live under a monarchy—they have choices. They can take their investments and ideas anywhere in the world."

He commented that younger entrepreneurs, who are globally connected and mobile, will not hesitate to move their capital elsewhere if the environment does not improve.

"And unless the government genuinely respects the private sector and listens to its concerns, the business environment will not improve."

"We can keep calling for investment," he concluded, "but without building trust and ensuring fair treatment, progress will be in jeopardy."

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments