MTB working to be a world-class bank

Mutual Trust Bank is working to be a world-class lender that will be a topper in every aspect of banking services, said Syed Mahbubur Rahman, managing director of the bank.

"In terms of governance, we are one of the best banks in Bangladesh. We have top-level management. The risk management team is the best in the market."

"Management is working to ensure banking services that are the best in the industry," he said during an interview recently.

The third-generation lender started its operation in 1999 and this year, it completed its 23rd year of operation.

According to Rahman, a lender should have higher paid-up capital, good governance, top-class management, good processes, and the best practices in IT management in order to become a world-class bank.

"MTB is focusing on strengthening the capital base and using it efficiently. It is also working to better customer service."

The bank is putting emphasis on the digital segment as well.

"We are one of the leading banks with digital infrastructure. We have world-class apps."

"Using the apps, our customers can carry out every transaction, from paying bills and tuition fees to doing grocery shopping. We are adding customer-friendly features continuously."

MTB has launched a virtual debit card and corporate credit card, the first of its kind in the country.

"The bank is a knowledge partner of the Bangladesh Bank on the digital segment," said the award-winning banker.

In order to diversify its portfolio, MTB has targeted to lend more to the agricultural sector and small and medium enterprises (SMEs). To make that happen, it is forging partnerships with fintech companies to extend low-cost loans to SMEs.

After completing his Master of Business Administration from the Institute of Business Administration at the University of Dhaka, Rahman started his career with Saudi-Bangladesh Industrial & Agricultural Investment Company Ltd. Later he worked for IDLC, ANZ Grindlays Bank, Standard Chartered Bangladesh, and Citibank NA.

Also, a former managing director of Dhaka Bank and Brac Bank, Rahman said the board of MTB does not interfere in the day-to-day running of the bank. Rather, the board is involved in drawing up policies and strategies.

"This is very important for a bank to be efficient."

He says MTB has policies for all of its activities. For instance, there are policies on promotion, procurement and appointment. "It should not be like that you give somebody a promotion on the basis of your preference."

The bank has run two audits to accelerate efficiency: one is regarding corporate governance, and the other is for ESG (environment, social, and governance).

The bank is pushing hard to promote sustainable finance. With a view to becoming a sustainable bank, it has taken steps.

"Our main goal is not to make a profit, but to be a sustainable bank," Rahman said.

MTB has some loans dated back to 2014-2016 that turned sour.

"We have targeted to clear the book by 2026-2027, so the bank is keeping provision aggressively."

"Once it is clear, we will be on our dream path because other issues are already at a satisfactory level. So, we are not declaring dividends aggressively."

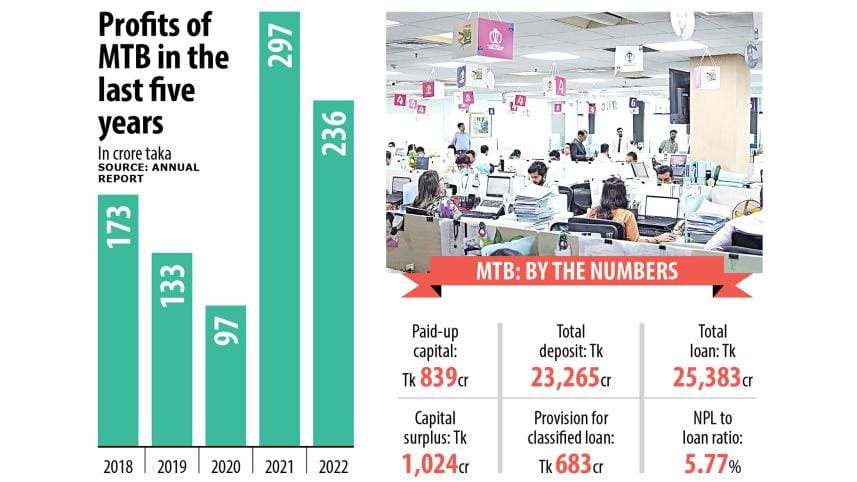

Its NPL to loan ratio was 5.77 percent in 2022.

The bank logged profits of Tk 236 crore last year, down from Tk 297 crore in 2021, according to the annual report. Outstanding loans totalled Tk 25,383 crore and deposits amounted to Tk 23,265 crore.

The former chairman of the Association of Bankers Bangladesh also talks about the challenges facing the banking sector.

"Many working loans are being converted into term loans because borrowers are not repaying them. Many of these loans have become NPLs. This is not a good sign."

He said many banks can't open letters of credit (LCs) owing to the US dollar shortage.

"Customers say if they can't open LCs how will they run factories and repay loans? So, my guess is the NPL will rise further in the coming days."

In Bangladesh, the NPL is not a new phenomenon. But it increased significantly in the last 13 to 14 years.

Once the NPL was prevalent in the state-run banks. Now, it is rising in the private banks as well.

"The reason is the absence of punitive measures," said Rahman.

Good governance is rare in many banks. Not everyone is following due diligence. Some are even crossing their limits in banking activities. Accountability is lacking."

"So, there is indiscipline in the banking sector and loans are being diverted to unintended areas. The number of willful defaulters is rising."

Although rules are there, the legal capacity to deal with a huge number of financial cases in the country is limited.

"In this situation, political will is vital to reduce NPLs," he said.

Speaking about higher inflation, the MTB chief said the government could allow a much higher interest rate to ease price pressures.

"The central bank has allowed a higher interest rate recently. If we delay in making decisions, the pain will be deeper."

Already, the liquidity has dried up in the market and some banks are struggling to keep adequate cash reserve ratio (CRR) and statutory liquidity ratio (SLR).

Rahman, who has won the Asian Banker Leadership Achievement Award, suggested banks invest in a very prudent way and keep enough liquidity at hand.

The government has reduced import costs through some restrictive measures to narrow the current account deficit.

But Rahman said: "This is not a sustainable way. You can't reduce imports continuously in an economy that relies heavily on the external market for growth."

The noted banker called for targeting attracting remittance through official channels to give a boost to the external balance as the hundi has risen significantly.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments