Loan disbursement for women entrepreneurs still very low

Although the growing number of women entrepreneurs in Bangladesh have mostly kept good payment records over the past decade, their share of the total loans disbursed by banks and other financial institutions still remains low, according to experts.

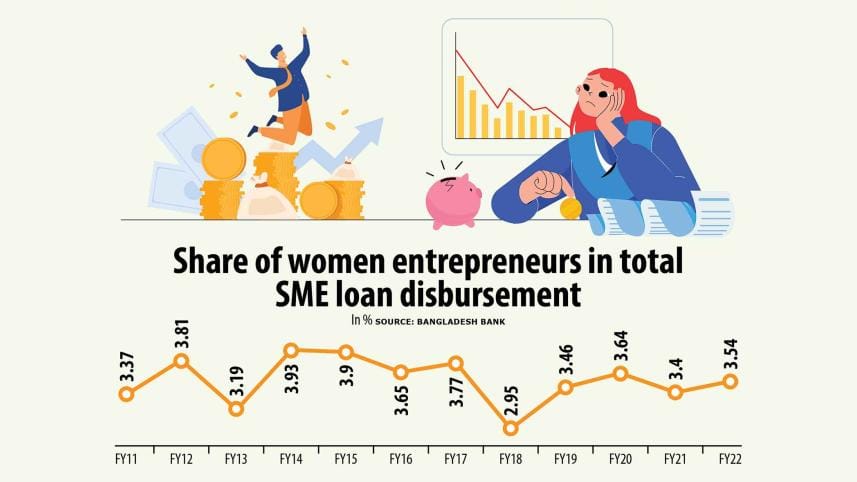

"There has been impressive growth in the number of female entrepreneurs, but their share in total loan distribution was just 3.54 per cent in the last fiscal year," said M Abu Eusuf, a professor of development studies at the University of Dhaka.

With this, the share of loan disbursements to women entrepreneurs has been confined to a modest 4 per cent for the past decade, he added.

Eusuf made these remarks at a seminar, styled "National and International Networks for Women Entrepreneurs: Potential Strategies for Addressing the Crisis", at the Bangabandhu International Conference Center in Dhaka yesterday.

The Small and Medium Enterprise (SME) Foundation under the industries ministry organised the event as a part of the 10-day SME Fair-2022 at the same venue. Regarding the progress of women entrepreneurship in the country, Eusuf termed it as sluggish.

"The way we are moving now, it [women entrepreneurship] cannot go too far in the future," he said.

Eusuf went on to say that relevant authorities will have to extend support by promoting backward and forward support to women entrepreneurs on various issues, including issuance of trade licences, financial assistance and marketing their products.

"The support should not be confined to just two or three days of training, rather we need to be involved with their business promotion and capacity building as well," Eusuf added.

Eusuf emphasised on the need for banks and other financial institutions to set aside a minimum 10 per cent of their total loans to cottage, micro, small and medium enterprises (CMSMEs) for financing women entrepreneurs.

"But this percentage must be raised to at least 15 per cent by 2024," said Eusuf, also an executive director of Research and Policy Integration for Development.

He then underscored the need for enhancing digital literacy and infusing ICT skills among women entrepreneurs to open a new network of opportunities for women-led businesses.

Melita Mehjabeen, a professor of the Institute of Business Administration at the University of Dhaka, said the government should build up the SME Foundation's capacity to strengthen women entrepreneurs.

"Although India has a ministry for the CMSME sector, we just have a foundation," she said.

About the success of women indentureships, she said women are very careful about their loans.

"We never hear of any woman being involved with a non-performing loan," Mehjabeen added.

Echoing the same, Mantasha Ahmed, a member of the board of the SME Foundation, said loan recovery among women entrepreneurs in the SME sector is very high.

Md Mafizur Rahman, managing director of the SME Foundation, also focused on the fund shortage.

"We have already reached around 30 per cent of the women entrepreneurs in Bangladesh," he said.

"But if we had enough funds and the government financially strengthened us, we would reach more women entrepreneurs," he added.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments