BB takes over 5 Shariah lenders in rescue merger

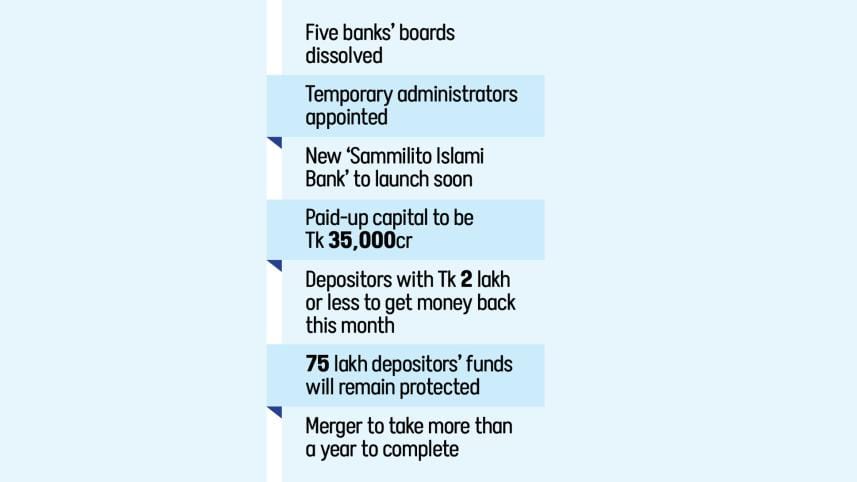

The Bangladesh Bank yesterday took over the five troubled Shariah-based banks on a temporary basis by dissolving their boards as part of the formal merger process.

Before dissolving the boards of directors, BB Governor Ahsan H Mansur met with the chairmen and managing directors of the five banks -- First Security Islami, Union, Global Islami, Social Islami and EXIM -- to inform them about the matter.

In a circular, the central bank said the five banks have been brought under the resolution process to restore good governance, ensure accountability, bring overall discipline in the banking sector, protect the interests of depositors and regain public confidence in the overall banking system.

In the biggest banking shakeup, the central bank also sent letters to the chairmen of the five banks stating that the lenders have been brought under the resolution process in accordance with Section 15 of the Bank Resolution Ordinance, 2025.

The central bank has declared the five banks non-functional, Mansur said at a press conference after the meeting with the bank chairmen and MDs.

Each bank will have one administrator along with an assisting team to carry out responsibilities.

The temporary administrations have been assigned four key responsibilities: to ensure that the banks remain operational and that large payments, remittances, and LC settlements continue smoothly; and to integrate and centrally manage the IT infrastructure, Mansur said.

The administrative teams will also assess staffing levels and the overall human resource situation and make necessary reorganisations, as well as rationally merge multiple branches of the banks located in the same area.

"The main objective of this initiative is to overcome weak financial management and establish a viable banking institution," Mansur said.

Sammilito Islami Bank, a new Shariah-based state-run bank that will be formed through the merger of the five troubled banks, is set to launch soon.

Although the new bank will initially be state-owned, it will be operated under professional management and a board, like a private bank.

The bank's paid-up capital will be Tk 35,000 crore, the highest among all banks in the country, said Mansur, adding that it will be the strongest financial institution in Bangladesh.

The authorised capital of the bank will be Tk 40,000 crore (each share of Tk 10, totalling 4,000 crore shares).

Finance ministry officials said that they have already prepared the application and relevant documents for the bank's licence, which were sent to the law ministry for vetting last week.

Once the vetting is completed, they will be forwarded to the BB, the officials said.

At the press conference, Mansur said that small depositors are likely to get back their money by the end of this month.

Since the new bank will be state-owned, there is no reason for depositors to worry, he said.

"From the very first day of the merger, profits will be provided based on market-based profit rates. Necessary safeguards have been put in place to prevent massive withdrawals."

Depositors with Tk 2 lakh or less will be able to withdraw their full amount soon.

For deposits above that limit, a phased withdrawal system will be introduced that will be announced later through a gazette notification.

"Through this merger process, the funds of more than 75 lakh depositors will remain protected. This merger process is for the people, the country and the long-term stability of the financial sector. Its successful implementation will bring significant positive stability for the next government and help rebuild confidence in the economy."

While it usually takes about two years to merge two banks, merging five banks will take even longer, he said.

"It will not be completed in a day, a month, or even six months -- it will progress step by step. We hope that the future government will continue this initiative."

The shareholders of the five banks will not receive any shares in the new bank as the value of assets tied to their existing shareholding is already negative.

The BB found in its calculations that while the face value of each share is Tk 10, the net asset value for each is Tk 350 to Tk 420 in the negative, Mansur said.

"So, the central bank is not taking them into consideration, as they hold zero liability."

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments