Private banks' profits slide on piling bad loans

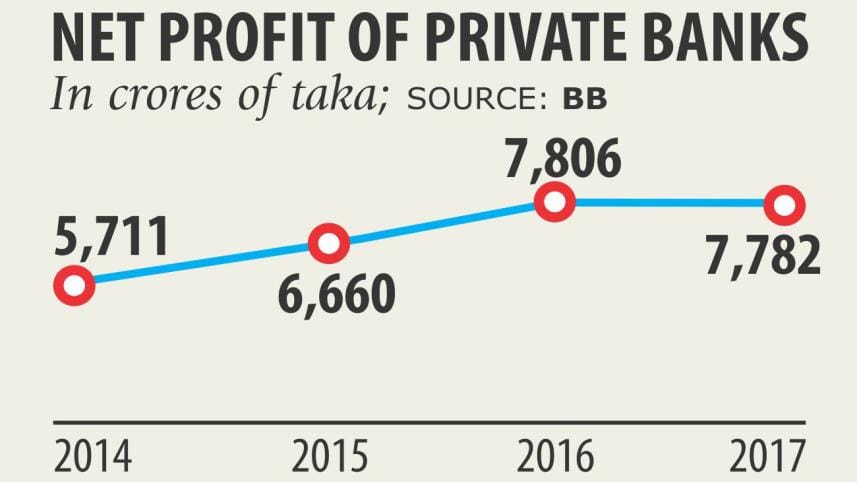

Private banks' net profits slid for the first time in four years in 2017, dragged down by their ballooning non-performing loans.

In 2017, private banks, most of which are listed on the stockmarket, counted Tk 7,782 crore in net profit in contrast to Tk 7,806 crore a year earlier.

They made operational profit of Tk 24,647 crore from which Tk 7,990 crore was deducted as tax and Tk 7,361 crore as provisioning against bad loans.

"The private banks' default loans had escalated last year," said Syed Mahbubur Rahman, managing director of Dhaka Bank.

So, the banks were compelled to keep large amounts of provisioning against the bad loans, which ultimately eroded their profit base, he said.

Of the 40 private banks, 17 saw their net profits decline from a year earlier.

Rahman, also the chairman of the Association of Bankers, Bangladesh, a forum of banks' managing directors, said the private banks would struggle to register growth in profits this year too given their ongoing liquidity crunch.

This is not good news for the stockmarket, as it means the listed banks might announce lower dividends to their shareholders this year, he said.

The private banks will have to recover their defaulted loans at any cost this year, said MA Halim Chowdhury, managing director of Pubali Bank. "Otherwise, their liquidity and profit crisis will deepen further," he added.

Khondkar Ibrahim Khaled, a former deputy governor of the central bank, said some private banks had faced financial scams last year that eroded their profits.

He went on to suggest that the private banks' actual net profits last year were lower than what is being reported: the majority of the private banks did not calculate their defaulted loan accurately to avoid keeping provisioning in a bid to enjoy net profits.

"The actual net profit might have been lesser had the private banks calculated the defaulted loan following all rules and regulations," Khaled added.

Among the private banks, Standard Chartered recorded the highest net profit of Tk 762 crore last year, followed by National Bank at Tk 653 crore and Islami Bank Bangladesh at Tk 624 crore.

But the overall banking sector's profits, however, grew 11.91 percent year-on-year to Tk 9,296 crore in 2017, on the back of some robust numbers logged in by state banks, according to provisional statistics from the central bank.

The six state-owned commercial banks—Sonali, Janata, Agrani, Rupali, BASIC and Bangladesh Development Bank—collectively logged in Tk 716 crore as net profit for 2017 in contrast to a net loss of Tk 511 crore a year earlier.

The state banks enjoyed robust profit based on their surplus liquidity, according to Rahman. "They invested their excess fund by lending them to private banks that were going through a liquidity crunch."

Besides, the government settled transactions for its mega infrastructure projects through the state banks, which also helped them generate good amount of net profit, he added.

The state banks' good run will continue this year too due to their available liquidity, according to Chowdhury.

"They will enjoy a charming year."

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments