Key role of MSMEs in achieving our development goals

There is no denying that in recent decades, the Micro, Small and Medium and Cottage Enterprises (MSMEs and cottage) sector has been thriving in Bangladesh, both in terms of its contribution to GDP as well as employment generation. In the last one decade or so especially, there has been an impressive expansion of the MSME sector—from around 2.3 percent in 1992 the contribution of this sector to GDP has escalated to 22.4 percent in 2020. The contribution of MSMEs and cottage (or in simpler term the SMEs) has even been more remarkable when we consider the contribution of this sector in generating employment, as this sector generates almost 80 percent of jobs in the industrial sector. As many as 24 million people are estimated to be engaged in MSMEs and that amounts to around 25-30 percent of the employed labour force.

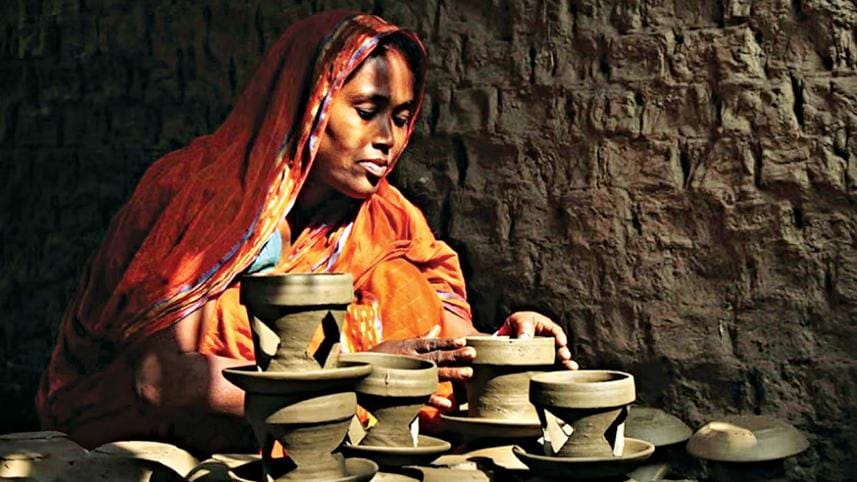

Besides, this sector also plays a vital role in the supply chain of many other goods and services and thereby helps to establish backward linkages for larger industries. Over time, the MSMEs have slowly emerged as a cornerstone of employment for women in Bangladesh with increasing number of women getting engaged in this sector. During the Covid-19 pandemic, despite being hit hard by the pandemic, it served as a source of livelihood for a large number of people. The sector, however, has several structural bottlenecks that are constraining its potential expansion, which includes constraints related to access to marketing, access to finance, access to information, infrastructural bottlenecks, complex bureaucratic constraints, technological shortcomings, etc. Such constraints are related partially to the small and fragmented structure and informal nature of the SMEs.

In terms of its constraints, accessing credit for the operation and gradual expansion and upgradation of this sector is a crucial one, due primarily to the lack of interest of the formal financial institutions to extend credit to the SMEs, and also for the ease of accessing credit from the informal institutions or NGOs. In order to deal with this constraint and for encouraging and incentivising the commercial banks, though the government as well as the central bank has taken a number of initiatives, there is still a low rate of penetration in terms of access to credit from formal institutions.

In this context, it is crucial to have a strong and favourable regulatory environment in terms of finance, business operation, etc. In particular, it is important to have flexible financing requirements and lesser documentation as well as greater flexibility in terms of regulatory requirements (e.g. requirements of trade license).

Another crucial area which constrains the activities of the SMEs, especially those in rural areas, is lack of market access and low level of integration with the consumers. This is also linked to lack of information of the existing facilities, schemes and support measures available to the SMEs. For example, in many instances, rural women in particular are unaware of any such available facilities. In this connection, there can be dedicated desks for the women entrepreneurs in union digital centres, commercial banks and union parishad offices to provide information about any such available facilities. These service points can also offer assistance for business operation of women entrepreneurs. In order to integrate them to the mainstream market, the government can take initiatives to incentivise the private sector and may also launch separate ventures to facilitate their market integration (e.g. Joyeeta like initiatives).

In recent years, online business activities have become increasingly popular due to greater demand as well as the ease of conducting businesses without much mobility or infrastructural facilities. In addition, though not a conventional SME, freelancing has come out as a fast-growing service-based platform for the urban youths in particular. However, a number of constraints related to the use of online based activities, for example, lack of smooth internet services, problem of electricity, lack of digital literacy, fragmented nature of the business, etc. are limiting the expansion of these types of initiatives. Given the vast potential of this sector, the government must emphasise on better structured policies, availability of better internet services and other facilities for the smooth operation of this sector.

Another fundamental problem related to the development of MSMEs and cottage businesses are related to the fact that the micro, small and cottage industries being particularly small and informal by nature, find it difficult to access any initiatives or incentives designed by the government of Bangladesh. For example, during Covid-19 the government of Bangladesh had extended support to the MSMEs and cottage industries in the form of subsidised loan and empirical evidence suggest that, though most of the micro and small enterprises were hit quite hard by the pandemic, only a small percentage of such firms managed to avail the incentive packages. Separate policy guidelines as well as regulations for the smaller entities in relation to credit, operation of business, taxation, etc. can be beneficial for their growth and profitability.

One of the important contributions of the MSMEs is its impact on women's employment and perhaps it will not be wrong to consider this sector as an alternative to the RMG sector when it comes to the question of women's employment. It is important to note that, with a view to facilitate employment generation of women, a number of initiatives have been adopted by the Bangladesh government and relevant bodies. For example, the SME Credit Policy 2010 of the Bangladesh Bank requires commercial banks to lend to women entrepreneurs with a targeted women's credit policy. The SME Foundation, the leading institute in connection to the SMEs has also taken a wide range of initiatives to encourage women entrepreneurs. Despite such initiatives, we are yet to see the desired results in terms of women's involvement in SMEs.

In addition, women entrepreneurs are also lagging behind their male counterparts in terms of the size and gravity of business activities. The reasonings for this gender gap is related to both demand as well as supply side factors. On the one hand, the service providers and relevant entities in connection to the financing and operation of the SMEs are often less interested to extend credit or other services to the women entrepreneurs. On the other hand, the women entrepreneurs, due to their lack of mobility, lesser access to information, low degree of linkage to the mainstream supply chain, are not in a favourable position, especially when we compare them to their male entrepreneurs.

On top of these constraints, the prevailing patriarchy and gender-centric societal norms discourage and even restrict women to get involved in mainstream labour market activities. Though it is difficult to change this complex narrative in favour of women with targeted policies and required budgetary allocations, a positive change can be brought in. In addition, a separate and more favourable set of regulations in terms of documentation/legal requirements/collateral, etc. for financing and operation and by practicing gender-sensitive service delivery at the supply side is urgently required to bring more women in MSME activities.

With increasing global competition facing the RMG sector, coupled with the recent macro challenges of the economy, the importance of the SME sector cannot be overemphasised. However, this sector lacks due attention in relation to both policy measures as well as budgetary allocation and incentives. The existing benefits are often argued to be confined to those of relatively larger size and greater degree of business activities. Much greater emphasis is needed in terms of policies and strategies as well as their implementations to facilitate the growth of this sector. As with proper policy measures and initiatives, this sector can turn out to be the most crucial determinant for growth and employment of the country.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments