Robi Airtel Merger: An opportunity to ponder

In September 2015, Robi Axiata Limited (Robi) and Airtel Bangladesh Limited (Airtel) expressed their desire to merge and made an application to the Bangladesh Telecommunication Regulatory Commission (BTRC) for initiating the merger process and recommendation for approval. If approved, Robi will have a 75% stake and Airtel a 25% stake in the merged company. A month later, BTRC agreed in principle to the merger but with certain conditions such as no reduction in work force after the merger and Robi taking the financial responsibility for Airtel's liabilities (the merger is also subject to the Telecom Ministry's approval). The merger, however, has met with some hurdles such as from the High Court on November 29, 2015 when it asked the government to explain, in response to a public interest litigation, why it would not be directed to assess the market impact of the merger by way of a competition commission, and most recently by the Prime Minister's ICT Adviser asking BTRC to seek public opinion before making a recommendation on the merger. Considering that this is one of the first large scale mergers in the telecom industry in Bangladesh, it is worth exploring some of the issues and ramifications of such a deal.

Before delving into the merger, it would be beneficial to see how the landscape of the mobile market is in Bangladesh. Figure 1 is a graph of the number of subscribers for each of the operators as well as the total subscriber base in Bangladesh since January 2012. Over the past nearly four years, the compound monthly growth rate of the total subscribers in Bangladesh is almost 1% and we have seen on average over this period more than a million subscribers being added to the market every month. By any standard, this is an impressive growth rate and is indicative of the mobile technology's affordability, ease of adoption, and of course the desire for society to use mobile technology. However, such a high growth rate cannot be sustained indefinitely. As of November 2015, the total number of subscribers is over 133 million; given that Bangladesh's population is about 160 million (with an annual growth rate of around 1%) and taking into account the addressable market of the population pyramid (e.g. excluding children), and that only a fraction of the population has multiple mobile subscriptions, the growth rate for mobile subscriptions is bound to slow in the coming years.

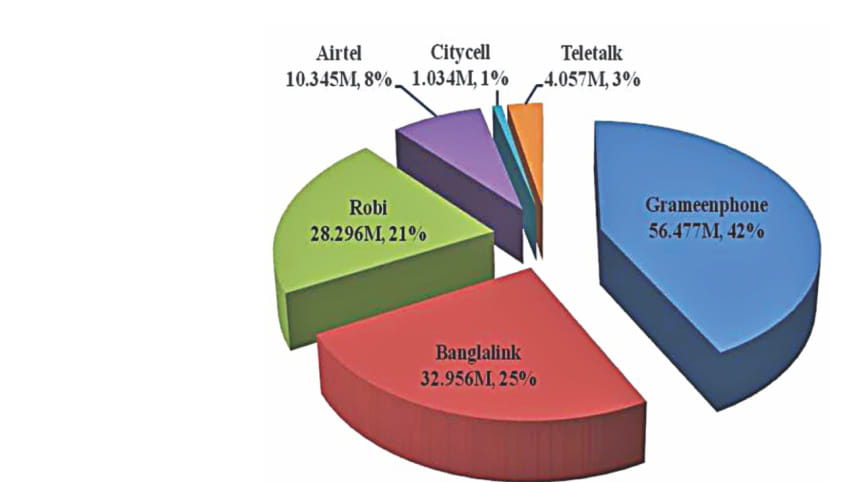

In terms of the individual operators of which there are six, we can see from Figure 1 that Grameenphone is the dominant leader and its lead over its nearest rival Banglalink continues to widen. Banglalink's closest competitor is Robi and they have both been on a somewhat parallel trajectory with a current offset of ~4.5 million subscribers. Airtel comes in 4th with a substantially smaller subscriber base but its growth rate has been quite good over the past year.

Given that growth rate will ultimately slow, market share becomes an even more important factor. Figure 2 shows the mobile operators and the number of their subscribers as well as their market share as of November 2015. Over the past four years, the market share range for each of the operators is as follows: Grameenphone: 41-43%, Banglalink: 24-28%, Robi: 19-23%, Airtel: 6-8%, Citycell: 0.5-2%, and Teletalk: 1-3.5%. This tells us that the market share of the operators has been quite static and that it is very difficult for any operator to take away market share from any other operator. Thus, a merger or acquisition is one of the only routes to increase market share. If the Robi Airtel merger were to happen right now, the combined entity would have a subscriber base of over 38 million and a market share of 29%, which would put it in 2nd position in the market. A point to note is that even if the merger were not to happen, it is likely that there will be changes in the market share landscape with the expected introduction this year of mobile number portability (MNP). Once a subscriber is able to switch carriers without the inconvenience of having to change his/her phone number, there will surely be a higher churn rate based on factors such as quality of service and more cost effective offerings from competitors.

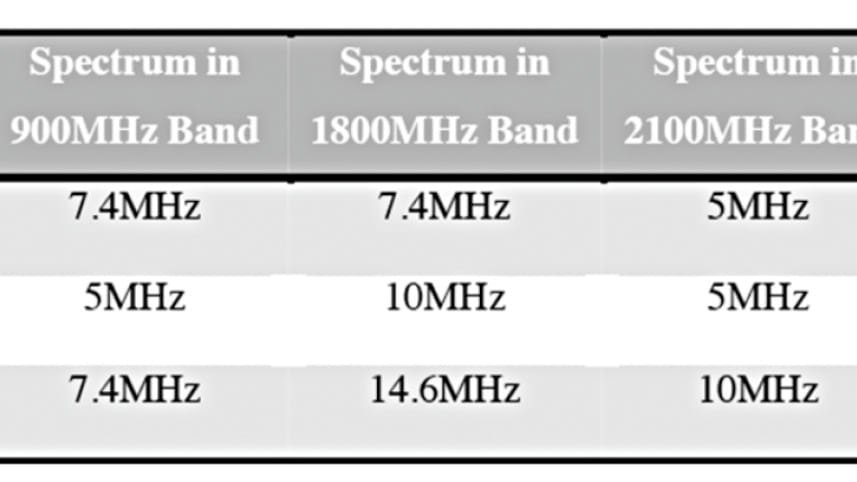

Let us look at some of the financial aspects of the merger aspirants. Robi has been profitable for at least the past three years while it is reported that the combined financial performance of Airtel Bangladesh and Bharti Airtel Lanka of Sri Lanka (Airtel Bangladesh does not report its profit/loss separately) has had losses in recent years. Robi's annual revenue is about Tk.5,000 crore while that of Airtel is less than Tk.1,400 crore. In terms of the number of cell towers throughout the country, Robi has more than 6,000 while Airtel has around 4,000. In terms of spectrum, Robi has a total of 19.8MHz and Airtel has a total of 20MHz. Table 1 shows the distribution of the spectrum in the various bands for Robi, Airtel, and Grameenphone (for comparative purposes). Currently in Bangladesh, the 900MHz and 1800MHz bands are assigned for 2G while the 2100MHz band is for 3G. The 1800MHz band is of particular interest to mobile operators as it is the preferred band for launching future 4G/LTE given that the government does not impose a restriction on the choice of band. The 1800MHz band is desirable as it gives a good balance between capacity and coverage. Thus, the combined entity of Robi and Airtel would have 39.8MHz with 17.4MHz in the important 1800MHz band. In comparison, Grameenphone has 32MHz with 14.6MHz in the 1800MHz band, and currently no other operator has more spectrum than Grameenphone in any of the bands. Though Airtel may be ailing, it brings valuable spectrum to the deal in addition to its subscriber base and tower infrastructure.

For Grameenphone, the spectrum of the combined entity poses both a threat and opportunity. Grameenphone is currently excluded from the first round of the auction of the remaining spectrum in the 1800MHz band based on BTRC's guideline that any operator having 20MHz or more in the GSM band (2G band which is the sum of spectrum in the 900MHz and 1800MHz bands) is not eligible to participate in the first round—and Grameenphone has 22MHz in the GSM band. As the Robi Airtel merger would give the new entity also more than 20MHz of spectrum in the GSM band, Grameenphone has written to BTRC asking if there will no more be a cap on 2G spectrum in order to participate in the first round auction, and in effect allowing Grameenphone to participate without restrictions.

Another issue that has arisen is that as per the Bangladesh Telecommunication Act, 2001, spectrum is not transferable and the question becomes does the merger constitute a transfer of spectrum. Section 55(4) of the Act states, “A licence issued or a frequency allocated under this section or the right to use such licence or frequency shall not be transferable, and if any such transfer takes place it shall be void.” One way to address this may be to cancel the existing licences of Robi and Airtel and issue a new licence to the new entity. The Act does envision mergers as can be seen in Section 37(3)(i) where it states that prior approval of BTRC is required in such an event.

The primary consideration for approval or not of the Robi Airtel merger by BTRC and the Telecom Ministry is whether there are any antitrust issues. In other words, will the merger result in substantially reduced competition that will ultimately not benefit consumers. The Robi Airtel merger would bring the number of mobile operators down to 5. If one looks across the globe, a substantial number of countries have 3-5 mobile operators so number-wise, the market will maintain a healthy number of competitors. The merged entity will also be in a better position to compete with Grameenphone's market dominance. Consolidation of Robi and Airtel should bring about savings in capital expenditure and operations, giving way to enabling them to further invest in next generation technologies that will result in a better user experience (e.g. better voice quality, less dropped calls, faster data rates) and a reduced cost for consumers and businesses. The merged entity would also give their subscribers better coverage in Bangladesh as the new entity's coverage area will be a union of their existing coverage areas.

There are of course potential drawbacks of the merger. A smaller operator (in this case Airtel) can be an aggressive challenger and initiate price wars; with the merger, we will potentially lose such a challenger. That role can in principle be taken up by Teletalk but that would require quite a change in mind-set, more investment, higher operational efficiency and better customer service from the government operator. The ICT Adviser has suggested Teletalk partner/merge with BTCL for mutual benefits that will improve the strength of both companies; an interesting suggestion that is fraught with its own issues as that would bring together a wireline and a wireless company that are both state-owned (and that deserves its own article). Another way to address the smaller aggressive challenger issue is to allow a new operator into the market. There is also of course the possibility of the merged entity not making as much investment soon in next generation network technologies.

Spectrum is playing an important role in the decision making of recommending/approving the merger as the merged entity will have a very large amount of spectrum, and the fact that the government will be having a spectrum auction soon. If the government deems that 39.8MHz is too much spectrum for a single company to hold based on the current market situation, it can put forth a condition that a certain amount of spectrum needs to be returned to the government and the merged company will receive compensation for the returned spectrum in terms of tax credits over a certain number of years. There will need to be negotiations of how much spectrum to return, from which band(s) the spectrum will be returned, and the monetary value of the returned spectrum.

There is speculation that the government may delay decision making on the merger and have the auction first in order to gain more revenue from the auction (in the hope that Robi and Airtel bid for spectrum if their merger fate is unknown). The government should keep these happens before the merger decision, so be it but it should not be by design. At the same time, the people want that the government get maximum revenue possible from the auction of the scarce resource of spectrum. As such, this would be a very good time for the government to give serious consideration to allow spectrum trading whereby operators are permitted to trade spectrum with existing or new operators. Spectrum trading provides operators the opportunity to optimise their spectrum resource—if they have too much they can sell their excess capacity and if they need more, they can attempt to buy it from the other operators. It also reduces the barrier to entry for new players as smaller blocks of spectrum can be bought from the existing operators as opposed to the large expensive blocks in a government auction. BTRC can impose limits on the maximum spectrum one can hold so that no monopoly is created via trading and the government can generate revenue by charging a spectrum transfer fee. Last but not least, the government can generate much higher revenue from its spectrum auctions if it allows spectrum trading—operators will not be as conservative in bidding for spectrum as they know they can trade any spectrum that turns out to be in excess for them, which is not the case today.

BTRC plans to take opinions from the other mobile phone operators on the proposed Robi Airtel merger prior to the public hearing. Some suggestions may be put forward by the operators that seek a level playing field but at the end of the day, the other mobile phone operators (who are all competitors of Robi and Airtel) will provide opinions that are in the best interest of their respective companies, which may not be in the best interest of the public. As a regulatory body, it is expected that BTRC will keep the benefit of the public at large as the most important criteria for recommending the merger. BTRC may want to consider consulting with Ofcom, the British communications regulator as there is a big mobile merger under consideration in the UK. Two UK mobile operators O2 and Three are seeking approval for a 10.25 billion pound merger that would make them the largest mobile operator in the UK. The deal is facing an inquiry by the European Commission, and both Ofcom and the European Commission are concerned that the merger may lead to higher prices for consumers and lower investment in networks.

In the world of communications, we are going through a technological revolution and it is imperative that regulators and policy makers be aware of future technology advances and changing business models so that they can swiftly adapt policies so benefits such as better network utilisation, more efficient use of spectrum (be it wireless or optical), and reduced cost may be fully realised. BTRC, Telecom Ministry, and ICT Ministry should be cognisant of some of these coming technologies so that appropriate regulations and policies can be thought through well ahead of time; technologies such as 5G, small cells, shared spectrum, leasing wavelengths as opposed to fibre in light of future higher optical data rates of terabit per second (Tb/s) and beyond, device and network security, converged networks, software defined networking (SDN), network function virtualisation (NFV), internet of things (IoT), and multi-tenancy in data-centers are just some of things that need to be pondered for the future but is in no way a comprehensive list. In addition, the government needs to consider being technology neutral in policy making so that the maximum benefits can be achieved in the most cost effective manner e.g. placing no restriction on which band 4G/LTE may be launched, as well as having a clear and detailed roadmap of the telecom sector.

It appears that 2016 will be an exciting year for the telecom sector in Bangladesh as we have a convergence of numerous important events ¬– merger decision, MNP, spectrum auctioning, etc. Our hope is that ultimately the consumers benefit from the decisions and actions taken by the actors in this arena. May the Force be with Digital Bangladesh.

The writer is the Chief Technology Officer for Optics in a globally leading telecommunication company.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments