Liquidity support for banks

Tk 18,500cr injected into four crisis-hit banks

The Bangladesh Bank has injected Tk 18,500 crore into four crisis-hit banks, namely First Security Islami Bank, National Bank, Social Islami Bank and EXIM Bank, against demand for promissory (DP) notes.

27 November 2024, 18:00 PM

Provide liquidity to weak banks or shut them

Depositors are now being affected as ailing banks are unable to return their money, experts said during a discussion, adding that the central bank should keep crisis-hit banks alive by providing liquidity support, opting to liquidate weak lenders or merging them with sound ones.

16 November 2024, 18:00 PM

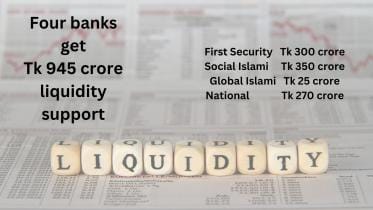

Four lenders get Tk 945 crore liquidity support from five other banks

FSIBL gets Tk 300 crore, SIBL Tk 350 crore, Global Islami Tk 25 crore and National Tk 270 crore

2 October 2024, 14:14 PM

Five crisis-hit banks secure BB guarantee for liquidity

Five crisis-hit banks have obtained a Bangladesh Bank (BB) guarantee to avail liquidity support from the inter-bank money market, according to central bank officials.

22 September 2024, 18:00 PM

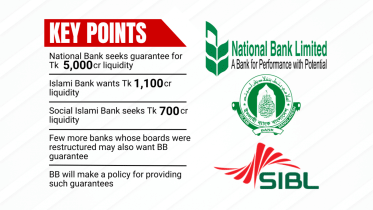

Three banks seek BB guarantee for Tk 6,800cr liquidity support

National Bank, Islami Bank Bangladesh and Social Islami Bank have applied to the Bangladesh Bank (BB) for its guarantee to avail a total of Tk 6,800 crore in liquidity support through the inter-bank money market for a period of three months.

11 September 2024, 18:00 PM

No more special liquidity support for any bank: BB governor

Bangladesh Bank has suspended liquidity support for some Shariah-based banks, says Ahsan H Mansur in a meeting with FBCCI

20 August 2024, 09:10 AM