Budget must reflect reality: Selim Raihan

The budget for the next fiscal year should be framed by taking into account the new challenges facing the economy and the cost of living crisis confronting people, said a noted economist.

"The budget should reflect the reality," said Selim Raihan, executive director of the South Asian Network on Economic Modeling, a think-tank.

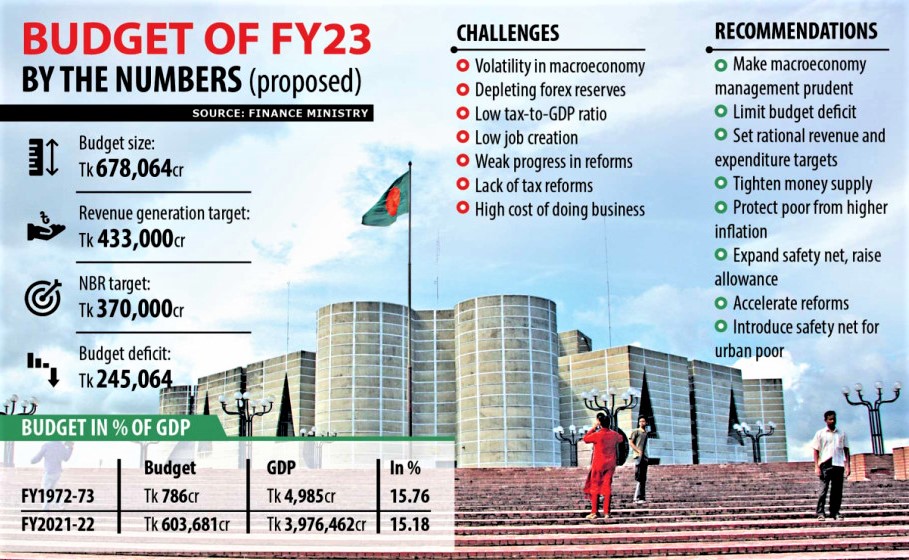

There are some new challenges facing the economy at the moment, which have combined to put an adverse impact on the macro-economy after a long time.

Subsequently, people's cost of living has gone up owing to higher inflation.

"It has to be seen how much of the realities the budget is acknowledging and taking steps accordingly to address them," said Raihan, also a professor of economics at the University of Dhaka.

There is significant pressure on the exchange rate, foreign currency reserves, and the balance of payments of Bangladesh. Remittance growth is slow.

The situation has compelled the government to abandon its complete control over the exchange rate and let the market decide the rate depending on the supply and demand.

"The move will have multifaceted implications, including stoking inflationary pressures. But if the economy can absorb the shocks, it will be able to come out of the crisis stronger," said Prof Raihan.

The exchange rate adjustment was badly needed to encourage the flow of remittance because when there is a major gap between the rates in the official market and the kerb market, migrant workers will tend to send money back home through the unofficial channel to get a better rate.

"The more the gap gets squeezed, the more the transfer of remittance through the official channel will receive a boost," said the economist.

The depreciation of the local currency will help exporters. However, other supporting measures have to be extended to them.

Owing to higher commodity prices, imports have posted an unexpectedly abnormal growth.

"There are already concerns whether over-invoicing is taking place in the name of imports. We have to see what steps the budget or the government take to address the issue," said Prof Raihan.

Usually, foreign currency reserves are deemed satisfactory if they can support imports for five to six months.

"In that case, a reserve of $42 billion is okay. But during a crisis that we are currently going through, this level of reserves might not be sufficient. We should target to elevate the reserves so that it can support imports for eight to 10 months," said the economist.

"So, we should be careful to avert any further depletion of reserves."

Prof Raihan thinks it would take time to bring inflation down to a tolerable level since it is part of the global crisis and not entirely in the hands of Bangladesh.

"So, social protection needs to have an expanded coverage in order to give some relief to the poor and the lower-income groups."

He says the government may need to further cut the import tariff on essential goods.

"We have to see what steps the government takes against anti-competitive practices such as hoarding and price manipulation."

He pointed out that the country's five-year plan document spells out major commitments about reforms. But the annual budget document does not reflect the commitment.

"Both are policy documents of the government. But if there is too much divergence between the policy documents, our goals stated in the five-year plans or the Perspective Plan would not be achieved if budget documents don't reflect them."

"So, reforms are mandatory and are very much needed," he said, adding that there is an immediate need to reform the financial sector, the taxation system and the trade policy.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments