First Security Islami Bank

Working committee formed for bank merger

The interim government has formed an eight-member working committee to implement the merger of five Shariah-based banks.

9 September 2025, 18:00 PM

First Security’s MD sent on leave for loan irregularities

An internal audit found Syed Waseque Md Ali’s involvement in loan irregularities with S Alam’s companies

4 January 2025, 15:05 PM

First Security Islami Bank sacks DMD

First Security Islami Bank (FSIB) has fired a newly appointed deputy managing director over his alleged involvement in irregularities at his previous place of employment, Social Islami Bank Limited (SIBL).

24 December 2024, 18:27 PM

First Security Islami Bank: Almost 90pc of Tk 2,254cr loan to Sikder Group sours

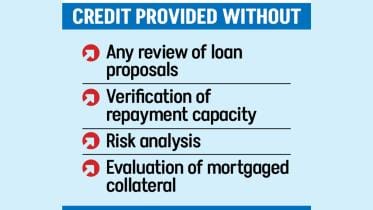

As much as 89.3 percent of the credit extended by First Security Islami Bank, when controlled by the major Awami League beneficiary S Alam Group, to AL-affiliated Sikder Group by violating banking rules and regulations has become defaulted.

19 December 2024, 18:01 PM

Four more Islamic banks take BB emergency loans

Four more shariah-based banks have been found to have taken emergency funds, which are usually taken during extraordinary circumstances, in an attempt at dressing up their balance sheet for last year.

3 January 2023, 02:00 AM

BB sends observers to Islami Bank, FSIBL

Bangladesh Bank yesterday re-appointed an observer at Islami Bank and dispatched an observer for the first time at First Security Islami Bank (FSIBL) -- the two Shariah-based lenders where Chattogram-based business giant S Alam Group has significant stakes.

13 December 2022, 01:00 AM

Islami Bank’s loan scams were not unknown to policymakers

Information about S Alam Group has bought a bank with money from another lender and taken controlling stakes in other banks is surfacing now, but people in the banking sector and involved in economic policy-making knew about the developments, said Ahsan H Mansur, executive director of the Policy Research Institute of Bangladesh.

6 December 2022, 02:00 AM

Kamal doesn’t know what is wrong with the banking sector

Islami Bank, Social Islami Bank and First Security Islami Bank lent about Tk 9,500 crore under suspicious circumstances, as reported by different media. Of the sum, Tk 7,246 crore has been taken from Islami Bank alone.

1 December 2022, 01:30 AM