Exim Bank’s profit dropped 9.4% in 2023

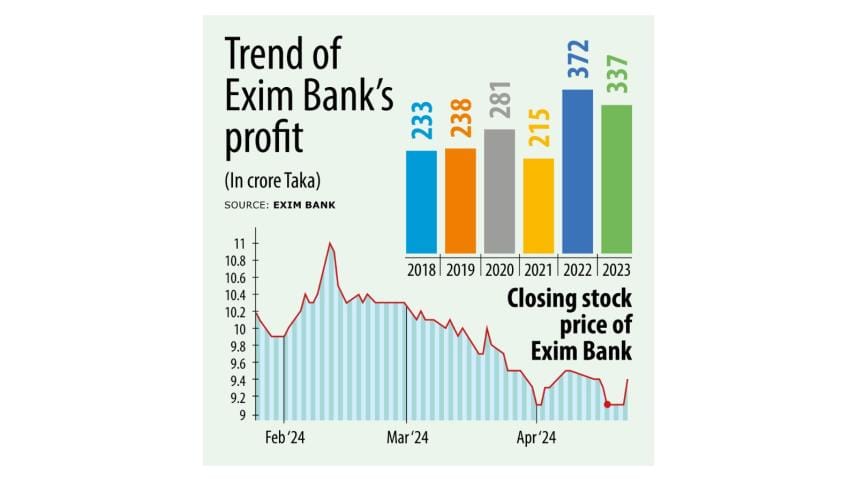

Exim Bank's profit declined 9.4 percent year-on-year to Tk 337 crore in 2023, according to a disclosure on the Dhaka Stock Exchange (DSE) website yesterday.

The Shariah-based bank had made a profit of Tk 372 crore in 2022.

Exim Bank's profit fell at a time when it has decided to merge with troubled Padma Bank.

However, the 2023 profit was its second highest in the past six years, meaning since 2018, as per its annual report of 2022.

As such, the private lender reported earnings per share (EPS) of Tk 2.33 for 2023 whereas of Tk 2.57 in the preceding year.

The EPS decreased mainly due to an increase in the amount kept as provision against investments, meaning loans, Md Monirul Islam, company secretary, told The Daily Star.

On the other hand, the net asset value per share rose to Tk 23 from Tk 22.

Net operating cash flow per share also surged to Tk 5.94 last year from Tk 13.2 in the negative the previous year.

This increase was mainly due to a rise in "deposits from customers" and "trading liabilities (borrowings)" compared to the previous period, read another Exim Bank disclosure on the DSE website yesterday.

At the board meeting, the bank recommended a 10 percent cash dividend for 2023. It had declared the same proportion in the preceding two years.

The bank will hold an annual general meeting on June 24 to approve the dividend and audited financial statements.

The lender and troubled Padma Bank signed a letter of intent to merge on March 18 this year.

At the end of last year, about 62 percent of Padma Bank's outstanding loans of Tk 5,740 crore had defaulted, according to Bangladesh Bank data.

In contrast, about 3.5 percent of the total outstanding loans of Tk 46,937.63 crore of Exim Bank had turned sour.

As per the central bank's guideline, the banks will have to reach consensus over the valuation of their assets and if they cannot, the BB will play the role of a mediator and help resolve the differences.

If that does not work, the merger decision may be cancelled, according to BB officials.

Exim Bank stocks rose 1 percent from that on the day before to Tk 9.40 at the end of trade at the DSE yesterday.

However, it had decreased by 3 percent to Tk 9.70 on Monday from Tk 10 on Sunday.

Established in 1999, the bank caters to the corporate, garment, cottage, micro, small and medium enterprise and agricultural sectors with 118 branches across the country.

As a part of its corporate social responsibility, the lender spends at least 2 percent of its annual profit every year for healthcare service, education promotion scheme, helping people affected by natural calamities, slum dwellers, and beautification of Dhaka city.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments