By Nuzhat Binte Arif and Nayeema Reza

'If Chuck Norris has five dollars and you have five dollars, Chuck Norris has more money than you.'

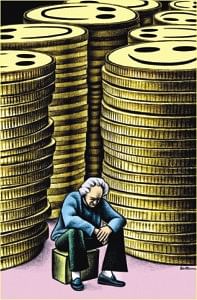

Money management is a tricky business and every teenager knows that. No matter how much you earn, it never seems to be enough to get you through the month. Dates, eating out, buying CDs etc all contribute in leaving a gaping hole in your pocket. But it seems that it does pay to be an organized person after all. It is high time to put the money back in your pocket and figure out ways to hold onto to it for a 'little' longer. Here a few important tips that need to be considered if you want your meagre income/allowance to last a whole long month.

Money management is a tricky business and every teenager knows that. No matter how much you earn, it never seems to be enough to get you through the month. Dates, eating out, buying CDs etc all contribute in leaving a gaping hole in your pocket. But it seems that it does pay to be an organized person after all. It is high time to put the money back in your pocket and figure out ways to hold onto to it for a 'little' longer. Here a few important tips that need to be considered if you want your meagre income/allowance to last a whole long month.

Budgeting

The first thing you need to ascertain how much you actually earn. This procedure isn't as difficult as it sounds, since you can keep tabs on all your income and that is easier than keeping tabs on your expenditure. Once you have figured how much you earn, it is time to make out a budget.

This would help you to understand how much you would actually be spending. Firstly, list all the necessary, and i mean NECESSARY, expenses. This includes transit fare, the cost incurred eating out which is a must for students who have classes all day and other things which are considered as essentials. Since you have your parents to worry about house rent, utility bills etc, focus only on what you MUST spend on. An example of it can be the bill that your cell-phone runs up. This should be definitely taken into consideration. If you have a prepaid line, then decide before hand how much you want to spend on it on a certain month and retain a certain amount for that. That takes care of the normal expenditure and this is actually not that hard and doesn't require much time.

Savings and Investment

There are numerous ways to do this. An easy method is to have a little piggy bank where you can store any chosen amount of money. Make sure the amount is feasible and significant and stick to saving the same amount, instead of decreasing it. You can have different banks to save for different things such as for the future, for some one's birthday or for a certain occasion.

You can also chose to have an additional sum cut out from your income in order to save it for something you want to purchase such as a brand new cell-phone. Once more stick to the same amount on a monthly basis. It is OK to increase the amount but it would be unwise to decrease the amount.

Opening a bank account can help the habit of saving, as you would be inclined to deposit a sum on monthly basis and this can help you in the future.

You can also chose to invest your money. For teenagers it is better to invest on stocks and shares with adult supervision, of course. This ensures that you can earn a monthly amount each month and this would serve to increase your income a tad bit more.

Remember, every penny saved and earned is extremely significant. You can also invest in worthwhile projects which are willing to take your money and obviously offer something in return for it.

Charity and A Day In Lavishdom

Charity and A Day In Lavishdom

It feels good to be charitable. The warm and fuzzy feeling that you get after contributing to a beneficial project, such as an orphanage, leaves you with a feeling that cannot be justified in monetary terms. You can even chose to give a certain amount monthly to any poor person you wish or you can gather enough money after months of saving to perhaps feed a few hungry people or clothe the naked. A more worthy ambition would always be to educate the illiterate. It doesn't matter how small you feel your contribution is, because every bit of it will help. Take it upon yourself to find someone to pay the money to instead of handing it to just any charitable organisation. Witness the smile it brings yourself.

All work and no play, makes merry men go bonkers, therefore it is absolutely fine to treat yourself every once in a while, specially when you have an unexpected rise in your income. Go out and enjoy yourself and live a day lavishly. That feels good as well. After all you do deserve it.

Finally, if you follow the above guidelines you just maybe able to go a whole month without being broke even once. That would leave you feeling satisfied and with correct saving methods you would feel secure. Stick to the rules and play the game right. Then, dear friend, it would be hard to mess up and face embarrassing situations.

Caution- Taking Loans or giving loans, may both result in unpleasant situations, therefore it is best to steer clear of the mentioned activity.