State of the economy and accountable development

Mamun Rashid

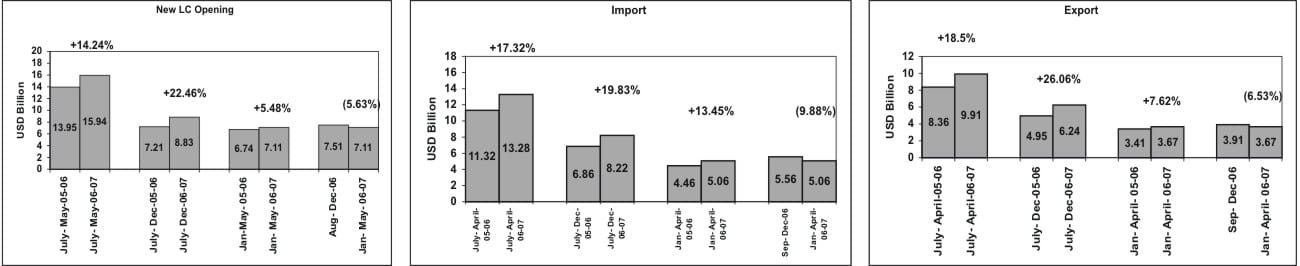

The political uncertainty and the disruption in the second half of fiscal year (FY) 2007 slowed down the Bangladesh economy. The economy is expected to grow at 6.1 % in the fiscal year that ended June 30. Year before, the GDP growth rate was 6.7%. In the next fiscal year, the GDP growth rate has been estimated to be 7 %. Export data for July-April'06-07 is USD 9.91 billion against July-April '05-06 USD 8.36 billion (18.5% growth). It was USD 10.53 billion in FY '05-06. Remittances for July-May '06-07 are USD 5.46 billion against in July-May '05-06 USD 4.37 billion (24.94% growth). It was USD 4.8 billion in FY '05-06. Import payment for July-April, '06-07 is USD 13.28 billion against July-April '05-06 USD 11.32 billion (17.31% growth). It was USD 14.74 billion in FY '05-06. New L/C opening for July-May '06-07 is USD 15.94 billion against July-May '05-06 USD 13.95 billion (14.24% growth). It was USD 15.24 billion in FY '05-06. Inflation for April '07 stood at 8.28% against 7.43% in March '07. Balance of payment for July-March '06-07 is USD 812 million surplus against USD 37 million deficit for July-March '05-06. Current Account Balance for July-March '06-07 is USD 318 million surplus against USD 523 million surplus for July- March '05-06. FX reserve at the end of June became USD 5 billion, which covers 3.76 months of import. Currently the budget deficit is at 3.9% of GDP and the forecast for 2007-08 is 4.2% (without BPC's liability) and 5.6% (with BPC's liability).The budget presented for FY 2008 shows revenue estimate of BDT 573 billion (Tax revenue of BDT 458 billion and non-tax revenue of BDT 115 billion) against the revised budget of BDT 494 billion (Tax revenue of BDT 392 billion and non-tax revenue of BDT 102 billion) for FY 2007. Foreign grants would be BDT 42.55 billion against the revised budget of BDT 21.5 billion for FY 2007. Total non-development expenditure would be BDT 529 billion against the revised budget of BDT 445 billion for FY 2007. Development expenditure is estimated at BDT 285 billion against previous year's estimate of BDT 234 billion. The size of the Annual Development Programme (ADP) is BDT 265 billion against previous year's BDT 216 billion. The overall deficit is estimated at BDT 298 billion (including BPC's liability) against previous year's BDT 173 billion. However, we need to be cautious about few potential threats as well. If we look at the trends of export, import payment (Please see the charts), we shall observe that all of the above were significantly lower in the second half of the FY 2007. Not only that, actually the numbers declined if we compare them with preceding months. This is a potential dangerous trend and we need to be extremely vigilant about this. Specially, if import declines significantly, we will see gradual trend of lower investment and growth. Also, we need to be careful about fuel price. In the international market, oil price is now at almost $70 and can go up further. In that case, if we do not raise the fuel price further (or make this market based), the losses of BPC will grow further. Already the government's decision to cover up for previous year's BPC losses will take our budget deficit to 5.8%. Unless we have a mechanism for market based fuel retail price, our budget deficit would create serious dent on our economy. The agriculture has been given special thrust in the budget, keeping almost 50% of the planned amount as subsidy. However, we have to make sure, all these reach the right target market. For this, we need to synergise the entire distribution channel, bringing in much more accountability in the local civil administration and local government machinery. We also need to train, develop and support people at agricultural extension department, improve the crop storage, fertiliser dealership and marketing system. The budget seemed to have encouraged imports. We needed that as a growth economy as well as eventually to support export growth. This will also help govt's revenue collection from customs duty at this point in time. Income tax realization has increased and exceeded the planned amount. Credit goes to establishment of large tax payers' unit (LTU) and driving this meticulously including incentivising efficient collections. We need to do the same for value added tax (VAT) also. Efficient VAT management can obviously help realign the excessive dependency on customs duty/import tariff. Overall efficiency of the tax administration, requisite automation and honest as well as knowledge based leadership at the top, rather can easily help exceed our 16% growth in revenue collection. Export and expatriate remittances still remain the growth drivers for our economy. Despite USD 5 billion FX reserve, we need to support dollar value against taka, to keep on encouraging our exporters as well as non-resident Bangladeshi remitters. Our exports have already become competitive, because of rise in labour cost in India and China along with depreciating Rupee and Yuan, we need to continue that. We also desperately need the upskill our work force. A minimum English reading and speaking can take a cleaner or day labourer to a hotel, a proper brick laying or plastering training can increase the daily wage of a mason or plumber thrice of what he is getting now. For that we can even think of engaging some of the NGOs, who have a proven track record of human resource development, especially in the rural areas, where most of the wage earners also come from. The government needs to drive reforms at every stage with military precision. Privatise the loss making state-owned enterprises (SoEs) quickly, withdraw its stakes from the profitable SoEs and multinationals though capital market, corporatise NCBs, Biman, BPC and other such institutions, recapitalise those through strategic investments from abroad, issue local or foreign currency bonds and take them for initial public offerings (IPO). They need to decide fast on the foreign direct investment (FDI) proposals. If we take `execution' as the single most important factor for taking the country to the next trajectory of growth, civil beurocracy still remains the `catalyst' for driving that growth through timely implementation of the required development projects and reach out the fruits of growth to the common people. We may lag behind some of our `peers', but our potentials can still be exploited and Bangladesh can still prove to be a country with tremendous potentials and future. We need to be cohesive in approach, consistent in our policy formulations and religious in `execution'. The writer is a columnist.

|

|