A policy for foreign investment should be in force

Ali Idris

WHEN investors from abroad come to invest in a foreign country, obviously their goal is to make profit and repatriate it. The investors do not come to do any favour to the country receiving foreign investment. Hence wherever the environment and conditions are favourable the investors would rush with their capital. In Bangladesh there are some favourable environment and easy conditions which attract foreign investment. That is why some remarkable investors including TATA group of India have shown interest in investment here recently. Whereas simply due to lack of existing set policies of investment, TATA's proposal has been postponed. An economic matter has been blanketed with political colour. Hence it is imperative that a policy for foreign investment must be formulated, revised and approved from time to time and applied whenever investment proposals are submitted so that the proposers have not to wait for long to know the result.Position of investments in Bangladesh

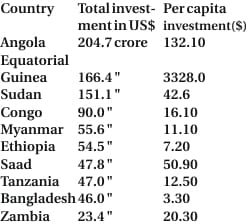

According a report published by UNCTAD in 2006, the picture of foreign investments in ten least developed countries of the world during 2004 is as the following:

It appears from the above table that during 2004 though Bangladesh occupied 9th position in terms of total investment, its ranking was the last according to per capita investment. This position seems not very encouraging. Hence it is essential that our country should have more and more foreign investment currently and in the coming years. The proposal of TATA group has been under scrutiny for almost a year. Political interception has most probably caused its postponement. But only political consideration can't run a country. Economic matters should not be engulfed with political views, rather it should be considered with professional expertise and financial analysis. When proposals for foreign investment flow in, it is better to get them examined by expert committees rather than keeping them pending. Arriving at decisions become easy if reference can be made to approved policy in force. It is therefore essential to have an approved policy or to compile one for this purpose. It is also necessary to revise the policy in pursuance to the need of the day. Necessary features of policy

Limit of repatriation of profit and participation of Bangladeshis in equity: It is learnt from a news item that during 2001 to 2005 foreign investors have repatriated their profit amounting to US$ 218 crore against investment of US$ 274.4 crore. In the same news it is stated that from 1996 to 2005 profit of US$ 362.6 crore (81%) has been repatriated against investment of US$ 445.7 crore. Breakdown of repatriated profit is 36 percent in telecommunication, 18 percent in textile industries, 7 percent in chemical industries, 18 percent in energy companies, 10 percent in banks, and 2 percent in electricity generating companies (The Daily Star 19-7-06). From the above data, it may be opined that the foreign investors can take out their total investment approximately in six years. In that case what monetary benefit the country gain through employment of people and collection of taxes, duty, VAT etc. seem not enough. In order to have more financial gain it is necessary that Bangladesh government or Bangladeshis are allowed to participate in equity. It would be easier for the general public to participate in equity through IPO and such participation would be allowed according to the percentage of profit earned in the industry ranging from 10 percent to 49 percent. If so done, a portion of profit will always remain inside the country instead of being repatriated, both foreign and local investment will grow and the country's industrialisation will accelerate. Even in the event of loopholes existing in the policy, the portion of local equity profit will remain within the country. In many of the Asian countries such participation of the locals in equity of foreign industries is in practice. Foreign investors should not be allowed to borrow from the local banking system: The main objective behind inviting foreign investment is to earn foreign exchange, profit and encourage industrialisation. If foreign investors are allowed to borrow from local banks in local currency, then foreign exchange will not be earned and local entrepreneurs will be deprived of local bank loans. Hence foreign investors should not be allowed to borrow in local currency, rather they may raise working capitals much as necessary through issue of shares to the local public. Repatriation of capital gain not before five years: Capital gain which is a non-business income should not be allowed to be repatriated before lapse of five years from the date of earning. This gain should be reinvested in business so as to ensure growth and development, but it may be repatriated at the end of 5th year or close of business whichever is earlier. Currently in Bangladesh this gain can be repatriated any time. Pricing of gas, coal, electricity for foreign investors: Usually all foreign investors are given land by the government on lease at easy terms. Rebate, exemption, holidays are also allowed to them in respect of taxes, duty and VAT. So the foreign investors enjoy special privileges. Furthermore if they are allowed concession in utilities like gas, coal, electricity etc. then it discourages the local industrialists due to the disparity created. But if gas or coal is used as raw material, then the price should be fixed at international rate or at the same rate as being in existing similar industries or sector. If a policy exists in this respect then it becomes easy for both the government and the investor. Recently in the case of the proposal of TATA group of India, probably the pricing of gas has been a major obstacle for arriving at the decision. Even after long negotiation and deliberation both parties could not reach a consensus. A committee which was constituted for study and giving is recommendation could not even come up with a report. Had there been a comprehensive policy in force, decision could be arrived in time. So a policy for foreign investments should always be in force. Ali Idris FCA is a finance executive.

|

|